Abstract

Emission reduction from the coal-dominated power sector is vital for achieving China's carbon mitigation targets. Although the coal expansion has been slowed down due to the cancellation of and delay in new construction, coal-based power was responsible for over one third of China's energy-related CO2 emissions by 2018. Moreover, with a technical lifetime of over 30 years, current investment in coal-based power could hinder CO2 mitigation until 2050. Therefore, it is important to examine whether the current coal-based power planning aligns with the long-term climate targets. This paper introduces China's Nationally Determined Contribution (NDC) goals and an ambitious carbon budget along with global pathways well-below 2 degrees that are divided into five integrated assessment models, which are two national and three global models. We compare the models' results with bottom-up data on current capacity additions and expansion plans to examine if the NDC targets are in line with 2-degree pathways. The key findings are: 1. NDC goals alone are unlikely to lead to significant reductions in coal-based power generation. On the contrary, more plants may be built before 2030; 2. this would require an average of 187–261 TWh of annual coal-based power capacity reduction between 2030 and 2050 to achieve a 2 °C compatible trajectory, which would lead to the stranding of large-scale coal-based power plants; 3. if the reduction in coal power can be brought forward to 2020, the average annual coal-based power reduction required would be 104–155 TWh from 2020 to 2050 and the emissions could peak earlier; 4. early regulations in coal-based power would require accelerated promotion of alternatives between 2020 and 2030, with nuclear, wind and solar power expected to be the most promising alternatives. By presenting the stranding risk and viability of alternatives, we suggest that both the government and enterprises should remain cautious about making new investment in coal-based power sector.

Export citation and abstract BibTeX RIS

Original content from this work may be used under the terms of the Creative Commons Attribution 3.0 licence. Any further distribution of this work must maintain attribution to the author(s) and the title of the work, journal citation and DOI.

1. Introduction

China, as part of its commitment to the Paris Agreement, has submitted a Nationally Determined Contribution (NDC) that pledges an emissions peak around 2030, among other things. Emission reduction from the primarily coal-dominated power sector is a critical task for China to achieve to meet such climate mitigation targets. Coal is the biggest power source in China, accounting for 37% of its energy-related emission in 2018 (Wang 2018, China Electricity Council 2019, National Bureau of Statistics 2019, National Energy Administration 2019).

The Chinese government has implemented several measures to slow down the expansion of coal power plants (Ren et al 2019), whereas the installed capacity of coal-based power plants is still growing. The annual capacity addition started to decrease in 2015, and in 2017 and 2018, this addition has been the lowest since 2005 (Endcoal 2019, Shearer et al 2019). Most coal-based power units have a technical lifetime of over 30 years; therefore, a lock-in effect could occur with a large-scale investment in coal-based power plants. The newly-built plants may get stranded in the future, as they could be incompatible with the well-below 2-degree (WB2C) target, which requires global electricity decarbonization by 2050.

To understand coal lock-in from a global perspective, Tong et al estimated CO2 emissions from existing and proposed fossil fuel infrastructure. They stated that this infrastructure will not help achieve the 1.5 °C target. Moreover, they pointed out the importance of the power sector in decarbonizing the energy system (Tong et al 2019). Cui et al compared the existing and planned coal-based power plant development with climate targets to demonstrate that the operational lifetime of existing coal plants should be reduced to 35 and 20 years to meet the 2 °C and 1.5 °C targets, respectively (Cui et al 2019). With a focus on the US, Lyer et al also found that coal power plants may face the risk of being prematurely retired by modeling the low-emission development strategy with the GCAM model (Iyer et al 2017). Some other studies that have focused on global climate change have also mentioned that China could face stranded risks in coal power. However, detailed analysis on the Chinese power system is limited, given their global perspective (Farfan and Breyer 2017, Edenhofer et al 2018).

Several studies have highlighted the stranded risks for China's coal-based power plants, based on the current status of electricity supply and demand (Myllyvirta et al 2015, Slater 2016, Yuan et al 2016, Yuan et al 2018). Only a few China-centric studies have considered CO2 mitigation goals when evaluating the future of coal-based power, with most of them suggesting to control the scale of coal-based power immediately. Spencer et al estimated the stranded value of coal-based power in China under NDC and 2-degree scenarios and suggested to halt new investment in coal power and to use the existing plants as backup capacity (Spencer et al 2017). Wand et al analyzed the low-carbon transitions of China's power system with the China TIMES model, and concluded that investing in coal-based power plants could become uneconomic once a stringent climate target is introduced into the system (Wang et al 2019). Fan et al explored the carbon capture and storage (CCS) retrofit potential of coal-fired power plants in China and concluded that CCS should realize commercialization before 2040 to make CCS retrofit a cost-effective solution (Fan et al 2018).

These studies provided valuable insight by presenting the coal lock-in issue and by proposing approaches for coal-based power reduction. However, further research is needed to understand the transition in the power system. First, model projections alone are not enough to evaluate the lock-in risks of coal power. The bottom-up data, which show the former and current investment in coal power, are also necessary. Second, the coal-based power reduction not only affects the existing coal-based power plants, but has an impact on the continuous electricity supply. Consequently, it is of great importance to see how the power system could react to the coal phase-out.

This paper combines bottom-up data on current capacity additions and expansion plans for power technologies and scenario results from integrated assessment models (IAMs), in order to analyze the lock-in effect of China's coal power industry. Based on the multiple models' results, we also explore the development potential of alternative power generation technologies, which can be used to close the electricity supply gap caused by the coal power reduction.

2. Methodology

As shown in table 1, this research involves five IAMs that demonstrate a harmonized scenario analysis for the Chinese energy system. The technology options for each model can be seen in SI.1.

Table 1. List of models used in this paper. 'Elastic demand' specifies whether energy (service) demand is price-elastic in the respective model, 'capacity calibration' specifies whether the calibration includes installed capacity and load factors (or only generation numbers), and 'early retirement' specifies whether complete early retirement of plants is an available option (though models without this option still can reduce load factors to some extent).

| Model period | Elastic demand | Capacity calibration | Early retirement | ||

|---|---|---|---|---|---|

| Global models | MESSAGE-GLOBOIM (Messner and Strubegger 1995) | 2005–2100 | Yes | No | Yes |

| POLES CDL (Després et al 2018) | 2005–2100 | Yes | Yes | No | |

| REMIND-MAgPIE (Luderer et al 2015) | 2005–2100 | Yes | No | Yes | |

| National models | China TIMES (Chen et al 2015) | 2010–2050 | Yes | Yes | No |

| IPAC-AIM/technology (Jiang et al 1998) | 2005–2050 | No | Yes | No |

By introducing national policies and climate targets into models, this paper designed three scenarios: reference scenario 'NPi,' '2C_early' and '2C_delayed'.

The 'NPi', which stands for National Policies Implemented scenario, represents the most important current energy and climate policies identified within the CD-LINKS project (NewClimate 2018). In the other two scenarios, that is 2C_early and 2C_delayed, a WB2C target is introduced in the models as a constraint on cumulative CO2 emissions (carbon budget). In global models, the budget is 1000 Gt CO2 for global energy and land-use systems between 2010 and 2100. From global models' results, the national budget for China between 2010 and 2050 ranges from 210–335 Gt. Thus, the prescribed budget for national models was chosen to be 290 Gt (for emissions trajectories, see figure SI.9, which is available online at stacks.iop.org/ERL/15/024007/mmedia in the Supplementary Information).

The '2C_early' scenario follows the NPi trajectory until 2020, and WB2C targeted mitigation begins thereafter.

The '2C_delayed' scenario follows the current NDC trajectory until 2030, and the WB2C targeted mitigation begins thereafter, without prior anticipation. For the NDC trajectory until 2030, we considered four goals of the Chinese NDC explicitly: a 60%–65% reduction of carbon intensity of GDP in 2030, compared with 2005; at least 20% of non-fossil fuels in primary energy in 2030; CO2 emission peak in 2030 or earlier.

To estimate the scale of coal power plants with stranded risk, we combined the coal power generation projection from IAMs and the existing coal capacity from statistical data. As different models have different inputs on the operating hours and technical lifetime, we made two major assumptions to improve the comparability: the full load hour (FLH) is assumed to be 4400 h, which was roughly the average level in 2015 (Yan and Yuan 2016); the technical lifetime is assumed to be 40 years, according to a former IAMs study (Krey et al 2019). The main idea is to calculate the demand of operating plants from IAM coal power generation projection, to calculate the actual capacity from the statistics and the assumed lifetime. Then, we use 'stranded capacity' to describe the gap between the demand and actual value of coal power capacity in this study. Therefore, in this study, the stranded capacity does not refer to those plants being completely stranded in the future. It is more the plants with risk of being completely or partially stranded. The detailed calculation method is introduced in SI.2, and the sensitive analysis on FLH and technical lifetime is shown in SI.3.

3. Results

3.1. Coal power generation in China under NDC goals and WB2C target

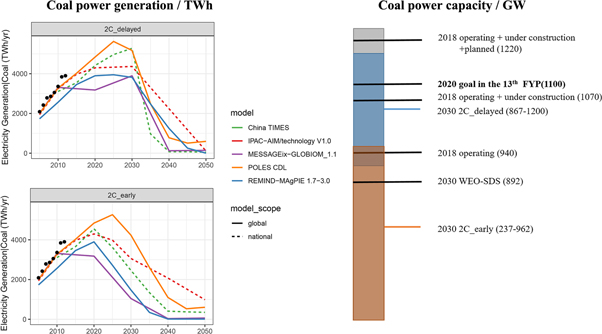

The current Chinese NDC is unlikely to lead to a significant reduction in coal power in the near future. Instead, there may be more investment in coal-based power plant generation capacity before 2030. From the models' results, coal power generation is expected to be 3820–5280 TWh in 2030, with three out of the five models showing an increase of 7%–22% from 2020 to 2030 (see figure 1). This increase implies that investing in coal power is still a cost-effective choice so far in most models.

If WB2C is to be met after achieving NDC goals in 2030, drastic reduction in coal-based power generation is necessary to break out of the coal lock-in. In the 2C_delayed scenario, most models suggested the elimination of coal-based power by mid-century, which requires a rapid coal phase-out from 2030. From 2030 to 2050, the models' results indicate that 187–261 TWh of coal power reduction should be realized every single year, which equals 3%–4% of the total electricity demand in 2018 (China Electricity Council 2019).

The first few years of the phase-out process can be especially challenging. During the first five years of WB2C mitigation (2030–2035), coal-based power generation should decrease by over 35% in all models. For the China TIMES and POLES models, this decrease may even reach 50%, as they will have a larger coal-based power expansion before 2030 than the other models.

If the WB2C mitigation could start from 2020 (as indicated in the 2C_early scenario), models would stop investing in coal power immediately. Early action could help to avoid the additional coal lock-in, leading to a smoother coal elimination process. From 2020 to 2050, the average annual reduction in coal-based power, which is obtained from the models, is expected to be 104–155 TWh per year. Although this change is still huge for the power system, this improvement from the 2C_delayed scenario is significant.

The 2C_early scenario requires that the coal power reduction start from 2020. In doing so, coal-based power generation would be 18%–73% lower than the 2C_delayed scenario by 2030. Early effort in controlling coal-based power could also help the energy-related CO2 emission to peak earlier. In the 2C_early scenario, CO2 emissions are able to peak before 2025 in all models with a 5%–15% lower peak value than those in the NDC scenario.

Two problems might arise due to the rapid coal phase-out in power systems: the existing coal-based power plants will face stranded risk, which could cause economic losses for investors; the sudden drop in power generation from coal could cause a supply shortage and alternative power generation plants will be needed to meet the electricity demand.

3.2. Stranded risk of investment in coal-based power

With a long technical lifetime, newly-built coal-based power plants are expected to be operational until mid-century, leading to a significant carbon lock-in risk. Krey et al found that the technical lifetime of coal-based power plants ranges from 30–60 years in IAMs (Krey et al 2019).

According to Endcoal data (Endcoal 2019, Shearer et al 2019), the operating units in 2018 were expected to emit 129 Gt CO2 in their remaining lifetime. Another 32 Gt CO2 of emission will be generated if all the units that are under construction and are being planned eventually get built. By the time they finish their lifetime, they would leave very tight emission space for other energy sectors.

3.2.1. Additional generation cost from the carbon price

To achieve the mitigation goals, a carbon price is applied to the models (see SI.4), which gradually increases as the emission space gets tighter. As the carbon price increases, coal-based power plants may lose their cost advantage over other technologies.

In the 2C_delayed scenario, carbon prices increase drastically after 2030. Before that, to achieve the NDC goals, models in this research suggest a carbon price of 0–30.5 $/t CO2. This price level should be achievable given the current status, which is the average carbon price that once reached 8.8 $/t CO2 during the pilot stage (Shuang and Zheng 2017). However, this price might not be enough to force coal power out of the system. In 2035, the carbon price would reach 24–194 $/t CO2 with a median value of 105 $/t CO2. With a carbon price of 105 $/t CO2, coal power generation will have an additional cost of around 0.103 $/kWh (given coal power's CO2 intensity is roughly 1 t CO2/MWh). In this case, most coal plants would lose their competitiveness.

The carbon price increase will be gradual in the 2C_early scenario; however, the increase is immediate once the WB2C target is introduced into model runs. This price change indicates the total cost of the energy system will need to be increased once the early action is taken in 2020. In 2025, the carbon price would be 0–54 $/t CO2 with a median value of 23 $/t CO2. With a carbon price of 23 $/t CO2, the generation cost of coal-based power will increase by 0.023 $/kWh. As a result, no more investment would go into coal power plants after that, while the electricity generation from existing plants may still be economical.

To achieve the WB2C target, the required carbon price in the 2C_delayed scenario may even reach over 500 $/t CO2 by mid-century. In 2050, the carbon price is expected to reach 48–693 $/t CO2, with a median value of 219 $/t CO2. In the 2C_early scenario, it could be reduced to 42–433 $/t CO2, with a median value of 181 $/t CO2.

3.2.2. Estimated scale of assets with stranded risk

In recent years, an overcapacity issue has begun in China's coal power industry, which is reflected in the decline of average operating hours. Since 2014, China's economy has entered the New Normal (Green and Stern 2015), which implies a slower GDP growth and a less resource-intensive development pattern in the coming decades. Therefore, the growth in electricity demand will also slow down. On the other hand, with the rapid growth of power capacity and the government's promotion of renewable power generation, the power generation demand for coal-based power plants is not as big as it was previously.

With the rising carbon price in the WB2C scenarios, a great number of existing plants as well as newly-built plants may face stranded risk in the medium to long term.

Figure 1. Left panel shows the coal-based power generation obtained from the models. Right panel compares the capacity data from different sources: the '2018 operating,' '2018 operating + under construction,' '2018 operating + under construction + planned' data comes from Endcoal (Endcoal 2019, Shearer et al 2019), the '2020 goal in the 13th FYP' data comes from the 13th Five-year Planning of China (National Development and Reform Commission 2016), the '2030 WEO-SDS' comes from the sustainable scenario in World Energy Outlook 2018 (IEA 2018), the '2030 2C_delayed' and '2030 2C_early' data comes from the models in this research.

Download figure:

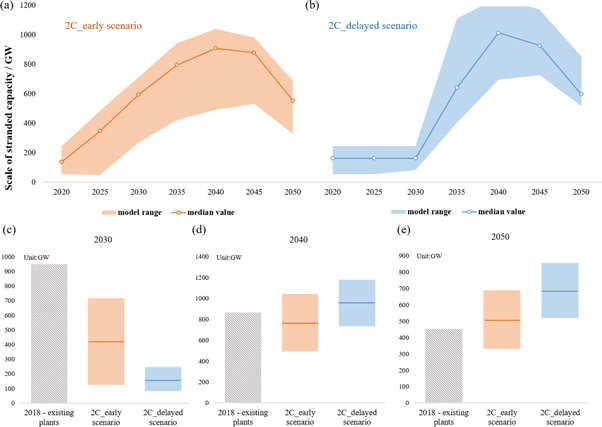

Standard image High-resolution imageA significant amount of the existing coal-based power plants may be still within their technical lifetime by mid-century. Based on the survey from Endcoal (Endcoal 2019, Shearer et al 2019), as of February 2019, the operating coal-based power units in China are around 940 GW and the average age of these units is roughly 11.5 years. In this research, we choose 40-year as a reference lifetime to estimate the stranded assets scale. Using this reference, 450 GW from plants already in existence in 2018 will still be operational in 2050 (see figure 2(e)).

Figure 2. Upper panel shows the estimated scale of stranded coal power plants in the 2C_early scenario (a) and 2C_delayed scenario (b). Lower panel further compares the stranded scale with capacity existing in 2018 with 2030 (c), 2040 (d) and 2050 (e). In the lower panel, the gray bar shows the plants that existed in 2018 while still within their lifetime in the given period; the orange bar and blue bar show the range of stranded plants in the 2C_early and 2C_delayed scenarios, respectively, with the line highlighting the median value.

Download figure:

Standard image High-resolution imageWith current NDC goals, 70–400 GW of new coal units are to be built during 2020 and 2030, and these capacities are more likely to face stranded risk in the later stage as coal-based power generation is expected to be zero by 2050, if a 2 °C compatible budget is to be used. In the 2C_delayed scenario, the stranded risks of coal power will drastically increase after 2030. By 2050, 500–850 GW of coal power units may face the risk of being stranded.

Early mitigation could help to reduce the stranded risk by stopping new investment to avoid additional coal lock-in. In the 2C_early scenario, most models stop building new coal power plants by 2020. This action can reduce the units with stranded risk by at least 150 GW, compared with the 2C_delayed scenario. Since coal-based power phase-out starts earlier in this scenario, the stranded risks may also occur earlier. Moreover, additional cost may occur with the early phase-out action: economic and political cost from stopping the ongoing coal-based power plants, new investment demand from building more clean power capacities to ensure electricity supply. However, from a long-term perspective, the 2C_early scenario will show its significant effect on reducing the stranded coal power plants after 2030.

Note that as the estimation of stranded scale is quite sensitive to the FLH and technical lifetime (Cui et al 2019), we also included a sensitive analysis (see SI.3). The first analysis shows the results under 4000 and 3500 h of FLH, and the second analysis shows the results under 30 and 35 years of lifetime assumption.

3.3. Possible alternatives under cost-optimal scenarios

In addition to the stranded risk of coal-based power plants, reduction in coal-based power generation will also bring new challenges to the promotion of other power sources.

In both 2C scenarios, the electricity demand will have continuous growth until mid-century (see SI.5), as the electrification process is critical in decarbonizing end-use sector energy consumption. In 2030, the electricity demand would increase by 41%–89% and 47%–106% in the 2C_early and 2C_delayed scenarios, respectively, compared with the 2015 level. This translates into yearly demand increases of 120–300 TWh yr−1.

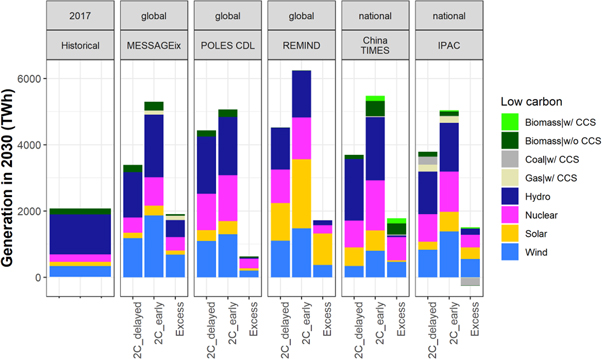

The 2C_early scenario could help to reduce the stranded risks, while this scenario requires an accelerated promotion of renewables, from 2020 onwards. As the coal power reduction begins 10 years earlier in this scenario than in the 2C_delayed scenario, more alternatives should be deployed to fill the electricity supply gap from then. In 2030, for most models, the low-carbon power generation in the 2C_early scenario is required to be 14%—56% higher than in the 2C_delayed scenario, as shown in figure 3.

Figure 3. This figure shows the low-carbon power generation in 2017, and in 2030 for the five models in both 2 °C scenarios. Furthermore, the 'excess' bar indicates the gap between the 2C_delayed scenario and 2C_early scenario.

Download figure:

Standard image High-resolution imageNuclear, wind and solar power are expected to make the biggest contribution to filling the electricity supply gap. As shown in figure 3, nuclear power generation would increase by 600–1320 TWh from 2017 to 2030 in the 2C_early scenario and account for the biggest share in the 'excess' generation by 2030 in the two models, namely POLES and China TIMES. Besides nuclear energy, intermittent renewables including wind and solar power are also projected to expand considerably by most models. Their generation growth from 2017 to 2030 would be 640–1580 TWh and 210–2020 TWh, respectively. Furthermore, other alternatives are expected to experience gradual development before 2030. Hydropower accounts for over 15% of all the gross electricity at present (China Electricity Council 2019). The expansion of hydropower in the future could be limited, as most of the resources with easy access have already been developed (Peng 2019). As for CCS-equipped generation technologies, they may not be able to play a significant role in the power system at present or in a near future because of their high generation cost (Liu and Tian 2017).

To further explore the possible transition strategy for China's power system, we provide more information on the major alternatives by combining the model projections with data on capacity additions in recent years and the near-term outlook of technologies.

3.3.1. Wide uncertainty about nuclear power

Although most models agree that nuclear power is an essential alternative during the coal phase-out process, there is wide uncertainty in the pre-2030 projection. In the 2C_early scenario, the capacity of nuclear power ranges from 120–210 GW in 2030. Given that the national plan for 2020 is 58 GW of nuclear power (National Development and Reform Commission 2016), the results from the models imply that the installed capacity should be double within ten years.

On comparing the models' results with historical trend, it was found that deployment goals from most models were rather ambitious. In 2018, the installed capacity for nuclear power in China was 45 GW (China Electricity Council 2019) and the units under construction and those planned were around 13 and 51 GW, respectively (World Nuclear Association 2019). To achieve the models' 2030 goals, projects currently under construction and those planned should be accomplished by then. Moreover, an additional 10–100 GW of new projects should be planned and accomplished. Compared to the historical data (the average annual addition in China was 4 GW in 2011–2018), the models' goals seem to be ambitious (see figure 4).

Figure 4. Upper panel shows the annual capacity additions of nuclear power; lines are from the models' results, black dots are historical data from China Electricity Council. Lower panel shows the annual capacity additions of solar PV power; lines are from the models' results, black dots are historical data from China Electricity Council. Left panels are for the 2C_delayed scenario and the right panels are for the 2C_early scenario.

Download figure:

Standard image High-resolution imageFrom a long-term perspective, great uncertainty in nuclear development still exists. By mid-century, nuclear power is expected to provide 15%–30% of the gross electricity in both 2C scenarios, with installed capacities ranging from 230–670 GW, compared to approximately 400 GW operational globally in 2019 (World Nuclear Association 2019). This uncertainty is also presented in many existing publications, including IPCC's Fifth Assessment Report (IPCC 2015) and Global Warming of 1.5-degree report (IPCC 2018).

If nuclear power is going to compensate for coal-based power reduction, inland plant projects would be necessary. To date, all the nuclear power plants in China are coastal plants, and it is still controversial in China to build inland plants (Wu 2017). However, a large share of the existing coal power plants is built to provide electricity in inland areas, which indicates that some of the new nuclear plants should be built in inland areas. In this case, two problems need to be solved: public acceptance and cooling water demand.

3.3.2. Shared underestimation of solar power

Wind and solar are both promising power sources for China, and they are expected to be the most important alternatives. In the 2C_early scenario, the installed capacity of wind and solar will reach 560–680 GW and 180–1400 GW, respectively, by 2030. Wind power is expected to have higher generation than solar power in most models (except for the REMIND model), which seems to be an underestimation of solar power (Creutzig et al 2017).

Solar power is experiencing rapid development in China. The annual capacity addition of solar power has exceeded the addition of wind power since 2016. In 2017 and 2018, a total of 54 and 44 GW of solar power capacity was installed in China. Meanwhile, the addition to wind power was 17 GW in 2018 (China Electricity Council 2019), see SI.7. In the 13th Five-year Power Development Planning (National Development and Reform Commission 2016), the solar power target has been set at 110 GW in 2020, and this target has already been achieved in advance, with China's capacity at the end of 2018 being 174 GW.

Most models have difficulty keeping up with the enormous dynamism experienced in the PV industry in recent years, both with respect to market growth and cost reduction (Creutzig et al 2017). In both the 2C_early and 2C_delayed scenarios, most models suggest a lower capacity addition than the historical reality, see figure 4. To reduce coal-based power between 2020 and 2030, the annual capacity addition in the 2C_early scenario is expected to be 10–39 GW in most models' results. Only the REMIND model has reflected a higher potential for solar power, which could reach up to yearly additions of approximately 200 GW in 2030.

Even from a long-term perspective, solar power development is still quite restrictive in most models. In 2050, most models project the total capacity of installed solar PV power to be less than 1500 GW in both 2C scenarios, which is even lower than the WEO expected values (IEA 2018) for 2040 in the sustainable development scenario.

The current growth of wind and solar power may be able to compensate for the annual coal power reduction in the 2C_early scenario. In 2018, combined wind and solar power generation was 123 TWh higher than that in 2017. Thus, the current addition levels are roughly enough to compensate for the annual coal power reduction that would be required for cost-optimal trajectories to stay within a 2 °C compatible budget. With a continuous increase in installation numbers, it could potentially compensate for most of the yearly demand additions of 120–300 TWh yr−1.

4. Discussions and conclusions

China's current NDC goals will not lead to a significant reduction in coal power. A drastic reduction is required post-2030 to break the coal lock-in. From 2030 to 2050, 187–261 TWh of annual coal power reduction is required to achieve the 2C_delayed scenario. As numerous coal-based power plants will still be within their technical lifetime, they would face great stranded risks. Certainly, completely retiring these plants is an extreme approach. A more realistic way is to operate them at lower load hours. It is still worth noting that even this 'partial stranded' risk could result in significant economic losses. One possible method to reduce the stranded risk is to introduce CCS technology into coal power plants. As Fan pointed out in a previous study (Fan et al 2018), if CCS commercialization can be achieved in 2030, the CCS retrofitting potential would reach 460 GW.

To avoid additional coal lock-in, the cost-effective scenario 2C_early suggests immediate stoppage of further investment in coal power. If China stops building new coal power plants from 2020, it is possible to lower the annual coal power reduction to 104–155 TWh, which could effectively reduce the scale of coal power plants with stranded risk.

The carbon price in all the models increases rapidly as we introduce the WB2C target, which is the direct reason for stranding coal plants. Moreover, even without the high carbon price, coal power is still losing its cost advantage in China. According to the National Energy Conservation Center (NDRC), with significant reduction in construction costs, solar PV and onshore wind power have already become cost-competitive with coal power in certain areas that are rich in resources (National Energy Conservation Center 2019). Meanwhile, China is making a great effort in exploring the reasonable carbon pricing method, which can further reduce the cost advantage of coal power.

Early coal control could prevent more plants from being stranded. However, more ambitious plans on the promotion of alternatives is required in the meantime, bringing additional cost to the energy system between 2020 and 2030. Among all the alternatives, nuclear, wind and solar are expected to be the most important between 2020 and 2030.

There is great uncertainty around nuclear power development. Therefore, we should be more careful about its planning, especially in the short term. From the models' results, the installed capacity of nuclear power ranges from 120–210 GW in 2030, which requires a significant speed-up on current promotion.

Given the rapid development in recent years, the promotion of wind and solar power may be able to compensate for the annual coal power reduction in the 2C_early scenario and even cover most of the increase in demand. In 2018, the increase in power generation from solar and wind power reached 120 TWh. However, it is worth noting that solar power may be underestimated in most models, since they present a lower capacity addition than the current situation in 2-degree scenarios.

A power system roadmap should consider the trade-off between all the power sources. With coal power being gradually phased out, the industry and its related employment will suffer (Spencer et al 2018); although, job losses in mining might occur even with stable demand due to productivity increase (IEA 2017). On the other hand, the coal phase-out could provide more opportunities in the renewable sector. In the case of the solar PV industry, China has built a complete industry chain for solar PV power with years of effort, which provided around 2.2 million jobs in 2017 (IRENA 2018). This industry supported the rapid deployment of solar PV power, but its future also depends on the sustainable promotion of PV in the coming decades.

In summary, these findings highlight two policy implications. The first one is that coal phase-out is necessary in pursuing the WB2C target in China and early action on coal power control can help avoid additional coal lock-in in the next decade. To realize smooth coal phase-out, a carbon pricing scheme with increasing prices could be considered. Besides, to reduce the potential economic losses of stranding coal plants, the power industry should take the development of CCS technology seriously. Second, the promotion of low-carbon alternatives should be accelerated when phasing out coal-based power, indicating the policy package should contain both control measures for coal power and promotion measures for alternatives. Given the rapid changes in the solar and wind power industry, future planning should make sure that the latest developments and near-term technology outlook are not only taken into consideration in IAMs or other evaluation tools, but in policy making.

This research has certain limitations, which could be tackled in future studies. First, we estimated the scale of stranded assets under 2C scenarios. However, the resulting economic losses were not evaluated. The monetization of stranded risk might provide more intuitive information, but would require more granular data. Second, as we already know the scale of stranded assets and also their age distribution, ways to reduce their economic losses is also necessary, for example retrofitting with CCS technology or use as backup capacity might be helpful. Third, for the promotion of alternatives, sensitive analysis considering the uncertainty in technical progress can be useful for the roadmap design, especially for technologies with rapid development, such as solar PV power. Fourth, we mentioned that renewables might play a significant role in closing the electricity supply gap, but as we did not explore the potential challenge on the load management, further study on detailed renewable planning would also be valuable.

Acknowledgments

The authors gratefully acknowledge the support from the National Natural Science Foundation of China (NSFC 71690243 and 51861135102) and the Ministry of Science and Technology of China (2018YFC1509006) for model development, and the European Union's Horizon 2020 Research and Innovation Programme under grant agreement No. 642147 (CD-LINKS) for scenario design.

Data availability statements

The data that support the findings of this study are available from the corresponding author upon reasonable request.