Abstract

This study analyzes the literature on environmental, social, and governance (ESG) disclosure by applying a bibliometric analysis of documents published in the Scopus database. The bibliometric analysis allows researchers to highlight the theoretical foundations of a specific research field, identify the main findings of previous studies, and determine future research ideas. This analysis was based on bibliometric authors' citation analysis, bibliometric papers' co-citation analysis, bibliometric references' co-citation analysis, bibliometric journals' co-citation analysis, co-occurrence keywords cartography analysis, trend and evolution analyses of ESG disclosure publications over the years, and qualitative content analysis. This study reviews 161 documents on ESG disclosure published in the Scopus database. Bibliometric analysis was conducted using VOSviewer, evolution analysis was performed using CiteSpace, and content analysis was performed using Wordstat. The study identified four major clusters: corporate social responsibility, corporate strategy, financial performance, and environmental economics. It also highlights the increasing number of citations and documents related to ESG disclosures. In addition, the journal 'Business Strategy and the Environment' significantly contributes to the ESG disclosure research field in terms of number of papers and citations. Additionally, this study highlights various future research opportunities in this field. The findings of this study have practical implications for ESG disclosure, such as the impact of integrating ESG into a company's business strategy on corporate and financial policies. This study is the only one to review key topics on ESG disclosure that can be largely used for ESG practices. This study provides an overview of how the literature on ESG disclosure has developed, as well as a summary of the most influential authors along with countries, organizations, and journal sources. This offers the opportunity for future research to focus on this topic.

Export citation and abstract BibTeX RIS

Original content from this work may be used under the terms of the Creative Commons Attribution 4.0 licence. Any further distribution of this work must maintain attribution to the author(s) and the title of the work, journal citation and DOI.

1. Introduction

This study focuses on environmental, social, and governance (ESG) disclosure, an area of great interest because of cumulative environmental and natural resource constraints. In the last decade, increasing environmental awareness of international legal bodies has prompted many countries to raise questions about sustainable development, and sustainability disclosure has attracted the interest of researchers and policymakers to examine the concept of a green economy [1–4].

At the international level, many organizations have developed various frameworks and procedures to help companies meet their disclosure obligations related to ESG issues. These organizations include the Global Reporting Initiative (GRI), International Integrated Reporting Council (IIRC), Sustainability Accounting Standards Board (SASB), Carbon Disclosure Project (CDP), and the United Nations Global Compact (UNGC). The developed frameworks provide companies with clear guidance on how to report their non-financial issues and help them identify and address their corporate social responsibility and environmental responsibilities.

In the last decade, ESG disclosure has become an integral part of investors' financial decisions, because of its ability to provide strong evidence of companies' commitment to environmental and social disclosure [5–9]. This concept has also attracted the attention of rating agencies such as Standard and Poor's, Moody's, and Fitch, which incorporate companies' ESG assessments to help them improve their scores and ratings.

Various studies have analyzed various aspects of ESG disclosure. A group of studies examined the extent of ESG disclosure and revealed that, although the level of ESG disclosure is still low, it has increased significantly over the years [10–12]. Other studies investigated the determinants of the extent of ESG disclosure [13–16]. Most studies focus on the impact of ESG disclosure on financial performance [17–21].

In recent years, bibliometric analysis has seen a significant growth in interest due to the increase of the number of software programs and multidisciplinary methods. This analytical method can help researchers identify trends in different research fields as well as journal performance. Through a bibliometric analysis, this study identified the most frequent ESG topics covered in the literature, identified various gaps in the literature, and identified paths for future research.

This study has six research questions. (1) What has been the trend in ESG disclosure publications over the years? (2) What authors, organizations, and countries have contributed the most to the research on ESG disclosure? (3) What are the most cited papers on ESG disclosure? (4) What are the most cited references in papers on ESG disclosure? (5) What are the most cited reference journals of papers on ESG disclosures? (6) What are the most frequent keywords and topics of ESG disclosure documents and their evolution over time? Questions two–five were answered by conducting bibliometric analyses, whereas question six was answered by employing two cartography analyses using VOSviewer and CiteSpace.

To the best of our knowledge, there is no single study on the bibliometric analysis of ESG disclosure papers published in the Scopus database. Therefore, this study sheds light on this topic. This study contributes to the literature by evaluating the most relevant topics in ESG disclosure research. The results identified four major clusters: corporate social responsibility, corporate strategy, financial performance, and environmental economics. In addition, the results reveal that the Journal of Business Strategy and the Environment makes an important contribution to the ESG disclosure research field in terms of papers and citations. Furthermore, this study identifies the authors, countries, organizations, and references that have been the most influential in publishing ESG disclosure studies in Scopus.

The remainder of this paper is organized as follows. Section 2 presents the methodology and data. Section 3 interprets the bibliometric results, section 4 presents the current topics and future research recommendations, and section 5 presents the conclusions.

2. Methodology and data

2.1. Methodology

This study applied trend, bibliometric, and content analyses using both quantitative and qualitative approaches [22]. Thus, the following analyses were conducted: (1) trend analysis, (2) bibliometric authors' citation analysis, (3) bibliometric papers' co-citation analysis, (4) bibliometric references' co-citation analysis, (5) bibliometric journals' co-citation analysis, (6) keywords and evolution analyses, and (7) qualitative content analysis. Bibliometric and evolution analyses were conducted using VOSviewer and Cite Space, respectively, whereas content analysis was performed using Wordstat.

2.2. Data

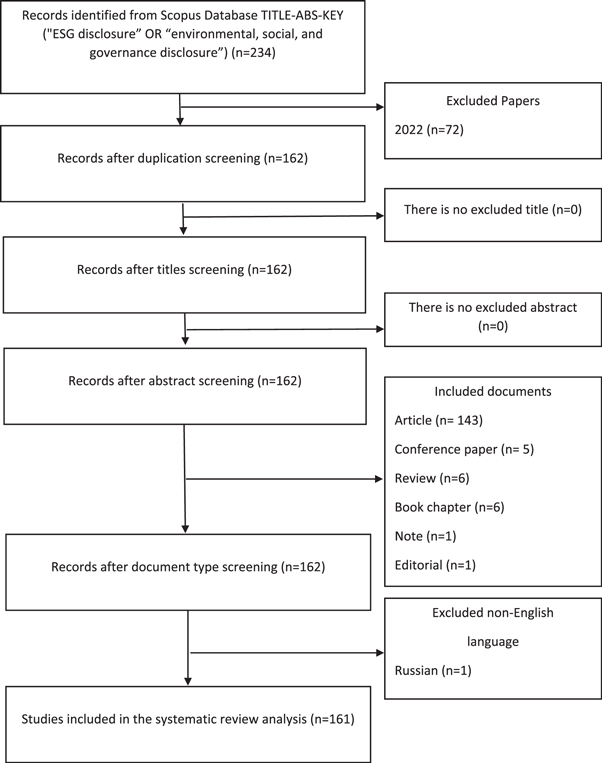

The Scopus database was selected because it is the world's most comprehensive overview of research outputs and is considered to be the largest repository of academic research documents that are of acceptable quality [23]. In this study, we use the keyword 'ESG disclosure' or 'Environmental, Social and Governance disclosure' in the article title, abstract, or keywords. This yielded a total of 234 documents. The data were screened in multiple stages, as shown in figure 1.

Figure 1. PRISMA diagram showing the number of documents at each stage of the screening process.

Download figure:

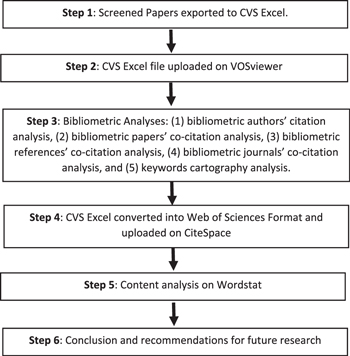

Standard image High-resolution imageAfter the data were screened, they were exported to CSV Excel and uploaded to VOSviewer for bibliometric analysis. In addition, CVS Excel was converted to the Web of Sciences format and uploaded to CiteSapce. The data extraction and conversion steps are illustrated in figure 2.

Figure 2. Data extraction steps.

Download figure:

Standard image High-resolution image3. Results of trend, bibliometric, evolution, and content analyses

This section summarizes the 161 documents on ESG disclosure included in this study by applying different trend, bibliometric, evolution, and content analyses.

3.1. Trend in publications on ESG disclosure

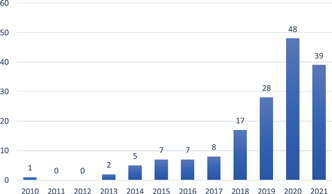

Figure 3 shows the number of articles published in the ESG disclosure research field. The first study on ESG disclosures was published in 2010. The development of this field was very slow during 2010–2017 with a maximum of 8 papers published per year. The number of ESG disclosures published documents increased in 2018, reaching 17 papers, and then continuing to increase until 2020 to reach the highest number of 48. In the following year, the number of papers witnessed a decrease, reaching a number of papers of 39. The increasing number of articles suggests that academic researchers are becoming more interested in ESG disclosure and are publishing their documents in the Scopus database. In this trend analysis, the increasing number of publications in the field of ESG disclosure is attributed not only to the growing recognition of the importance of this field but also to the increasing integration of ESG disclosure into business strategies and corporate reporting practices.

Figure 3. The trend in ESG disclosure publications.

Download figure:

Standard image High-resolution image3.2. The most influential authors, organizations, and countries

The top five cited authors, along with their respective organizations and countries, are presented in table 1. It shows that the UK has two authors from the top five list (Buallay A. and Yu E), and Greece has two most-cited authors (Giannarakis and Konteos). The remaining country in table 1 is Australia, which is emerging in research on ESG disclosure.

Table 1. Most cited authors, organizations and countries.

| No | Author | Papers | Total papers' citations | Samples of papers | Organization | Country | Author's google scholar citations |

|---|---|---|---|---|---|---|---|

| 1 | Buallay A. | 6 | 214 | [20, 24–28] | Brunel University, London, Ahlia University, Manama. | UK, Bahrain. | 958 |

| 2 | Giannarakis G. | 6 | 326 | [13–15], [29–31] | University of Western Macedonia | Greece | 1855 |

| 3 | Konteos G. | 3 | 105 | [29–31] | Technological Educational Institute of Western Macedonia | Greece | 301 |

| 4 | Luu B. | 3 | 131 | [32–34] | University of Sydney | Australia | 152 |

| 5 | Yu E. | 3 | 131 | [32–34] | Birkbeck University of London | UK | 994 |

3.3. The most cited papers

This section presents an analysis of the top ten cited documents on ESG disclosure published in the Scopus database from 2010 to 2021. Table 2 shows that the topics of the most cited papers were mainly related to the impact of ESG disclosure on financial performance [18, 35–38]. Other studies have considered ESG disclosure as a practice of integrated reporting [1, 39, 40].

Table 2. Top 10 cited documents on ESG disclosure topic.

| Paper | Citations | Title | |

|---|---|---|---|

| 1 | [36] | 190 | ESG performance and firm value: The moderating role of disclosure |

| 2 | [35] | 185 | The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance |

| 3 | [38] | 180 | Corporate social responsibility and financial performance: A non-linear and disaggregated approach |

| 4 | [37] | 169 | The impact of environmental, social, and governance disclosure on firm value: The role of CEO power |

| 5 | [41] | 165 | Diversity of Board of Directors and Environmental Social Governance: Evidence from Italian Listed Companies |

| 6 | [18] | 139 | Do environmental, social, and governance activities improve corporate financial performance? |

| 7 | [42] | 137 | Sensitive industries produce better ESG performance: Evidence from emerging markets |

| 8 | [39] | 137 | Environmental, social and governance disclosure, integrated reporting, and the accuracy of analyst forecasts |

| 9 | [1] | 121 | Corporate Sustainable Development: Is 'Integrated Reporting' a Legitimation Strategy? |

| 10 | [40] | 118 | Integrated reporting and integrated thinking in Italian public sector organizations |

3.4. Most cited reference papers

This section presents the most cited references included in published documents on ESG disclosure. Table 3 lists the ten most cited reference papers. These studies focus on the following topics: (1) the relationship between corporate social responsibility disclosure and financial aspects [43–48], (2) the determinants and motives of corporate social responsibility disclosure [49, 50], (3) the impact of corporate governance on corporate social responsibility disclosure [51], and (4) agency theory explaining engagement with stakeholders [52].

Table 3. Most cited reference papers in documents on ESG disclosure.

| Cited Reference | Citations | Title | |

|---|---|---|---|

| 1 | [49] | 17 | ESG in Focus: The Australian Evidence |

| 2 | [43] | 15 | The Impact of Corporate Social Responsibility on Investment Recommendations |

| 3 | [50] | 14 | Determinants of corporate social responsibility disclosure ratings by Spanish listed firms |

| 4 | [44] | 13 | Corporate social responsibility and access to finance |

| 5 | [45] | 13 | Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting |

| 6 | [46] | 12 | Corporate Social and Financial Performance: A Meta-analysis |

| 7 | [51] | 11 | The Impact of Board Diversity and Gender Composition on Corporate Social Responsibility and Firm Reputation |

| 8 | [47] | 11 | Corporate Social Responsibility and Firm Financial Performance |

| 9 | [48] | 11 | Environmental risk management and the cost of capital |

| 10 | [52] | 10 | Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure |

3.5. Most cited references journals

This section presents the top ten cited reference sources by employing a bibliographic coupling analysis. Table 4 lists the top journals that published papers on ESG disclosures. Nine of the ten journals were ranked as Q1, with high SNIP factors. Emerald has the highest number of papers on ESG disclosure, followed by Wiley. Business Strategy and Environment was the top journal with the highest number of papers (15) and citations (743).

Table 4. Most cited reference journals.

| Source | Papers | Citations | Publisher | Scopus quartile | SNIP factor | |

|---|---|---|---|---|---|---|

| 1 | Business Strategy and the Environment | 15 | 743 | Wiley | Q1 | 2.289 |

| 2 | Sustainability (Switzerland) | 14 | 121 | MDPI | Q1 | 1.31 |

| 3 | Corporate Social Responsibility and Environmental Management | 8 | 396 | Wiley | Q1 | 2.044 |

| 4 | Sustainability accounting management and Policy Journal | 6 | 250 | Emerald | Q1 | 1.063 |

| 5 | Management Decision | 5 | 195 | Emerald | Q1 | 1.458 |

| 6 | Journal of Sustainable Finance and Investment | 4 | 56 | Taylor and Francis | Q1 | 1.241 |

| 7 | British Accounting Review | 3 | 485 | Elsevier | Q1 | 2.525 |

| 8 | Corporate Governance (Bingley) | 3 | 64 | Emerald | Q1 | 1.403 |

| 9 | Journal of Applied Accounting Research | 3 | 125 | Emerald | Q2 | 1.216 |

| 10 | Journal of Business Ethics | 3 | 171 | Springer Nature | Q1 | 2.366 |

3.6. The most frequent keywords

Co-occurrence analysis of all keywords was applied to conceptualize the development and growth of ESG studies. To arrive at a meaningful analysis [22], a minimum threshold of two for the occurrence of a particular keyword was required and filtered. This resulted in 138 keywords for 568. The results are reported in figure 4 and show that the most frequently used words are corporate social responsibility, corporate governance, sustainable development, financial performance, and environmental economics. The frequent occurrence of these keywords among studies reflects more analyses applied to the impact of corporate governance mechanisms (including the ownership structure and board of directors) on ESG disclosure, as well as the impact of ESG disclosure on financial performance. The most commonly used theories are the agency, legitimacy, information asymmetry, and stakeholder theories.

Figure 4. Keywords analysis.

Download figure:

Standard image High-resolution imageAs shown in figure 4, there are four major clusters: corporate social responsibility (red), corporate strategy (blue), financial performance (green), and environmental economics (yellow).

In the large corporate social responsibility cluster, there are four groups of studies:

- 1-

- 2-

- 3-

- 4-

Studies in the corporate strategy cluster have considered ESG disclosure as a strategic approach integrated into a business strategy to improve corporate engagement with stakeholders [21, 67] and corporate commitments toward the environment [2, 63].

In the financial performance cluster, studies have mainly focused on analyzing the impact of ESG disclosure on corporate performance [17–21]. Some studies have focused only on developed countries [68, 69] or emerging markets [5, 42, 60], whereas others have compared developed and developing countries [26, 70].

There are two groups of studies on environmental economics clusters. The first group explained the necessity of disclosing an ESG report using legitimacy theory [1, 71–74] and stakeholder theory [61, 75, 76]. The second group elaborated on the company's efforts to reduce carbon emissions and climate change [67, 77].

In addition to VOSviewer, CiteSpace was used to analyze the most used keywords in the different stages and development patterns in the papers published by ESG disclosure. The most-cited keywords were calculated and arranged in CiteSpace by time and frequency to form the time view shown in figure 5. The figure shows the most frequently used keywords during 2010–2021. The two keywords of 'corporate social responsibility' and 'corporate governance' were frequently included in papers till 2013, suggesting that early interest in ESG disclosure was closely related to corporate social responsibility and corporate governance. For instance, Giannarkis [13] explored the extent of corporate social responsibility information disclosed by US companies, and the ESG scores were considered determinants of the extent of this disclosure. Murphy and McGrath [78] explained the different motivations of ESG reports by considering, among others, the reduction of litigation in corporate governance. In the following three years, new keywords emerged, which can be divided into five main groups: (1) corporate governance mechanisms: institutional investors [79] and board gender diversity [41, 80], 2- corporate environmental commitments: global reporting initiative [81], integrated reporting [40, 82, 83], and environmental economics [14, 30], (3) theoretical framework: legitimacy theory [72–74, 84, 85], and stakeholder theory [61, 76, 80], (4) impacts of ESG disclosure: sustainable development [1, 2], and performance [18, 25], and (5) empirical approach: content analysis [86, 87], bank [25, 81], and developing countries [5, 88, 89]. In 2021, researchers were interested in examining the integration of ESG investment in business strategy [90, 91] as well as the impact of ESG disclosure on the cost of debt [92–96]. The evolution of the topics reflects the fact that researchers have started to legitimize ESG disclosure through theories, understand its determinants, explore its extent, and then examine its potential associations with corporate governance, financial performance, and sustainable development in different institutional contexts. Most of these studies applied content analysis.

Figure 5. Evolution in ESG disclosure research documents over the years.

Download figure:

Standard image High-resolution image3.7. Content analysis of the previous research topics

In addition to bibliometric analysis, qualitative content analysis of titles and abstracts of ESG disclosure papers published in Scopus was conducted using Wordstat. The major themes were corporate governance mechanisms, methodology approach, performance, sample, corporate social responsibility, financial leverage, integrated reporting, sustainable development, green innovations, stakeholder engagement, and theory. Table 5 presents the results.

Table 5. Content analysis of the previous research topics on ESG disclosure.

| No | Topic | Keywords | Cases | % cases |

|---|---|---|---|---|

| 1 | Corporate governance mechanisms | Institutional investors; investment decisions; CEO; duality; compensation; independence; women; size; board; committee; audit; directors; diversity; gender; transparency; efficiency; determinants; board size; board composition; ownership. | 357 | 22.27% |

| 2 | Methodology approach | Proxy; score; extent; Bloomberg; CSR; social; governance; environmental, regression; analysis; multiple; linear; panel data; panel regression; data analysis. | 338 | 21.09% |

| 3 | Performance | Negative; positive; association; significant; effect; disclosure; profitability; firm; level; relationship; performance; shows; results; ordinary; firm performance. | 295 | 18.40% |

| 4 | Sample | Oil; sector; Oil and gas; exchange; stock; listed; period; stock exchange; listed companies; supply chain; developing; developed. | 258 | 16.09% |

| 5 | Corporate social responsibility | Benefits; sustainability; social responsibility; corporate social responsibility; corporate sustainability. | 95 | 5.93% |

| 6 | Financial leverage | Leverage; financial leverage. | 67 | 4.18% |

| 7 | Integrated reporting | Organizations; integrated; reporting; GRI; institutions; standards; framework; integrated reporting; sustainability reporting; integrated thinking; reporting standards. | 56 | 3.49% |

| 8 | Sustainable development | Development; sustainable; current; economic; standards; sustainable development. | 43 | 2.68% |

| 9 | Environmental economics | Green; innovation; enterprises; climate; change; impacts; strategies; issue; lead; climate change; green innovation; GHG; emissions; company; initiatives industry; policy. | 38 | 2.37% |

| 10 | Stakeholder engagement | Pressure; society; practices; quality. | 33 | 2.06% |

| 11 | Theory | Legitimacy; theory; institutions; stakeholder; legitimacy theory; stakeholder theory. | 23 | 1.43% |

| Total | 1603 | 100% |

Table 5 reveals a high similarity with the bibliometric keywords' clusters and the sub-cluster analysis included in section 3.6. It indicates that the most frequent research themes in ESG disclosure are related to the association of ESG disclosure with corporate governance as well as with the corporate performance. The two additional themes are methodological approach and sample. Table 5 indicates that the panel data are the most common and the methodological approach applied in determining the extent of ESG disclosure relies on a proxy measured by the content analysis [72, 86, 87] or Bloomberg score [32, 64, 95, 97]. With regard to the sample, the industry varies from one study to another. For instance, studies have focused on oil and gas companies [98–100], while others have analyzed the supply chain industry [64, 101].

4. Current topics and recommendations for future research

In addition to the analysis of titles and abstracts of previous ESG disclosure papers, another content analysis was conducted on the current topics of the most recent papers published until July 25th, 2022. The results are presented in table 6.

Table 6. Content analysis of the current research topics on ESG disclosure.

| No | Topic | Keywords | Cases | % cases |

|---|---|---|---|---|

| 1 | Sample | Listed companies; panel data; global; airline industry. | 156 | 24.22% |

| 2 | Stakeholders engagement | stakeholders; information; sustainability; practices. | 77 | 11.96% |

| 3 | Performance | Influence; profitability; differences; association; significant; financial performance; corporate financial performance. | 74 | 11.49% |

| 4 | Corporate governance mechanisms | Size; board; women; investors; board size; women on board. | 66 | 10.25% |

| 5 | Investment efficiency | Investment; efficiency; investment efficiency; intangible capital. | 59 | 9.16% |

| 6 | ESG rating | rating; accounting; ESG rating. | 49 | 7.61% |

| 7 | Methodology approach | Methodology; design; approach; regressions; design methodology approach. | 49 | 7.61% |

| 8 | Environmental economics | Climate; change; risk; responsibility; risks; literature; climate change. | 41 | 6.37% |

| 9 | Sustainable development | Sustainable; finance; development; business; responsibility; sustainable development; sustainable finance. | 39 | 5.06% |

| 10 | Corporate social responsibility | Corporate social responsibility; mechanisms; responsibility; practices. | 34 | 5.28% |

| Total | 644 | 100% |

Table 6 reveals that most of the research topics are similar to previous ones, including stakeholder engagement, performance, corporate governance mechanisms, corporate social responsibility, sustainable development, and environmental economics. However, in the methodology approach, there is a higher focus on regressions than on the content analysis considered in previous studies. In addition, the airline industry has recently been included in a sample of recent studies [102, 103]. The new topics that have emerged in recent studies are investment efficiency and ESG ratings.

Recent studies agree that ESG disclosure increases corporate transparency and hence improves capital investment efficiency by mitigating under- and over-investment problems [8, 104]. In addition, there is greater interest in examining the impact of ESG disclosure on ESG ratings [105–108].

- 1-Future research on ESG disclosure may include the following topics: the COVID-19 pandemic, which has caused a global crisis, and it would be interesting to consider it as a recent topic to examine its impact on the extent of ESG disclosure and analyze the commitment of the companies towards not only their stakeholders but also the whole community.

- 2-Earnings management: Earnings management practices relate to information manipulation. It would be interesting to analyze the impact of ESG disclosure on these practices to assess corporate transparency.

- 3-Diverse samples: Most studies on ESG disclosure consider listed companies in different financial markets. It would be interesting to include other types of organizations (such as family businesses, small and medium enterprises) as well as other types of industries (such as education, tourism, and real estate).

- 4-External corporate governance mechanisms: In the analysis of the association between ESG disclosure and corporate governance, there was only consideration of internal mechanisms (such as ownership structure and board of directors), while further studies should include external mechanisms (such as market competition) because of their potential impact on ESG disclosure.

- 5-Moderating role: The previous studies have investigated the direct relationships between ESG disclosure and other corporate and financial aspects, while it would be interesting to analyze the moderating role that could be played by ESG disclosure in other relationships, such as: the relationship between corporate governance and financial performance.

5. Conclusion

This study analyzes published ESG disclosure papers in Scopus to determine their contributions to the ESG literature, identify the key concepts and ideas related to this field, and propose recommendations for future research.

By applying several bibliometric, trend, and content analyses, the most productive authors, along with organizations and countries, have been identified. In addition, the results identify five major clusters: sustainability, ESG disclosure, corporate social responsibility, environmental, and environmental disclosure. Moreover, the results reveal that the Journal of Business Strategy and the Environment has experienced increasingly important growth in the ESG disclosure research papers and citations, reflecting its significant contribution to the ESG research field.

This study has theoretical and practical implications. First, it aims to provide a comprehensive overview of ESG literature by identifying the most significant studies and topics related to this field. Second, it helps researchers gain an idea about the most recent ESG topics as well as the most cited papers and relevant references. Third, the findings of this study can be used by ESG disclosure researchers to identify areas of future research that they should focus on. For instance, they can analyze various issues related to the COVID-19 pandemic to manage ESG disclosure efficiently. In addition, it has been observed that there is a gap in the literature regarding the associations between ESG disclosure and earnings management practices which is considered an unexplored research field. In addition, most studies have relied on legitimacy and stakeholder theories. Because the dynamics of the business environment can change over time, it is important for researchers to constantly evolve their theories to improve their findings. Moreover, the main thrust of ESG disclosure theories has been adopted as a uniform approach, but it can also be applied in different ways depending on the characteristics of corporate governance and institutional frameworks.

This study also highlights the importance of optimizing ESG disclosure to address critical corporate decisions, such as strategic investment decisions and earnings management. This field has been acknowledged as leading research exploring the various characteristics of strategic ESG integration into a company's business. Much research should be conducted in this field, as most studies have focused on the impact of ESG disclosure on financial performance, as well as the impact of corporate governance (including the attributes of the board of directors) on the extent of ESG disclosure.

The importance of ESG practices is acknowledged by society and investors who are not only interested in financial performance, but also in corporate environmental and social performance. Companies should not only focus on achieving financial success but should also contribute to achieving development goals at all levels of a company's strategic and financial decisions. This will be of great interest to future research. The internal ESG policies of companies should not only be designed to maximize financial performance, but also to promote sustainable development goals in preventing climate change, pollution, and social and gender inequality.

Future studies should examine other databases to analyze trends in the ESG disclosure field. This study focuses only on documents published in the Scopus database. Despite these limitations, this study provides a useful overview of the previous and current literature on ESG disclosure.

Data availability statement

The data that support the findings of this study are available upon reasonable request from the author.

Funding statement

This study was not supported by any funding source.

Conflict of interest

The author declares no conflicts of interest.

Paper type

Literature Review.