Abstract

Innovations in the physical sciences face unique challenges and barriers as they transition from concept to product, and finally to profitable business. Specifically, time horizons are much longer and early-stage capital needs are much higher than for alternative investments in, for example, information technology or consumer electronics. Universities with significant research programs in the physical sciences are most significantly affected as early-stage investors who are willing to accept high risk and the associated liquidity penalty become scarce. A potential solution to this dilemma is the implementation of a lab-to-market roadmap within the university infrastructure to align process, metrics and funding, with the goal of guiding technology translation in a disciplined fashion, while generating meaningful returns at low risk to the institution. Such a roadmap for early-stage technology entrepreneurship is described here, with start-up activity integrated into the universities' research activity and with a focus on three critical success factors: (1) a robust process for start-up activity; (2) an educational program that teaches the process and helps participants to implement it; and (3) an infrastructure that creates the appropriate environment for academic organizations to effectively develop innovations into products that are positioned to become great companies. For examples of the methodology, a case study for the start-up process (Cronos Integrated Microsystems) is reviewed and a successful lab-to-market case study at Duke University is also provided.

Export citation and abstract BibTeX RIS

1. Introduction

Translating new innovations from the university lab to the market is challenging, particularly for early-stage technologies that are based on scientific breakthroughs in the physical sciences. These innovations include advances in materials science, clean technology and the biomedical field. Indeed, it is well known that the probability of moving a technology successfully from research through to product is exceedingly low—thousands of ideas may eventually lead to just one successful product or company [1, 2]. The reason for this is that the actual invention, or the technology behind the invention, comprises only a small portion of the ingredients necessary for success; much more needs to be done to translate research from innovation to product.

The translational process at universities has been found to be generally inefficient [3] and while data exist to support the general positive impact that universities have on regional innovation, the same work questions whether moving in the direction of more applied research at universities is in fact useful [4]. Others have stated more directly that commercialization at universities is 'akin to purchasing a lottery ticket' and argue that faculty should be kept focused on social, not economic development roles [5]. However, it is evident that the role of the university has changed and continues to change over time: our university system has evolved from an initial mission of pure teaching to one that includes research and now to one that also includes social development, which broadly includes technology translation [6]. And, while technology transfer may be measured to be inefficient, significant resources are being expended [3] and the most critical question at this point is how universities can effectively move from a passive to an active role in the process [7].

Successful technology translation is in fact a multidisciplinary effort that includes skillsets outside of those typically taught to researchers who create the core invention. Moreover, for researchers in the university setting, the choice of application for their technology generally reflects a variety of forces (grant availability, collaboration, departmental focus, etc) that differ significantly from the forces that drive success in the market (market size, competition, customer acceptance, etc). Finally, for technology translation to be successful, fundamental challenges need to be overcome relating to a myriad of factors, including most importantly: the time it takes for a new technology to penetrate the market; the changes in skillsets and work force culture required as the technology is successfully translated and the company grows; and the level of funding needed to be successful.

The literature is rife with relatively consistent sets of analyses and recommendations for improving technology translation at the university, including: development of a commercially supportive culture at the university; increasing the financing available for technology translation; improving technology transfer offices; reducing bureaucracy at the university; and increasing training at universities around technology transfer [8–11]. More importantly, there is increasing support for a systems approach that leverages government funding, endowments and private equity in an infrastructure that supports a disciplined process [7, 9, 12]. And while many of these analyses and recommendations are accurate and almost unsettling in their consistency, practical solutions are not yet nearly as evident.

2. Understanding the environment: timing and funding

2.1. The innovation lifecycle

Practical solutions need to start with an excellent understanding of the technology translation environment. Timing and funding are two related issues that we need to understand deeply before we embark on technology translation efforts.

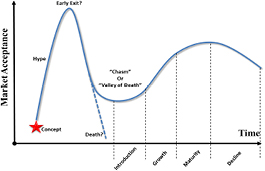

Technology translation comprises the initial stages of the innovation lifecycle (figure 1)—at least through to the point where product introduction is successful. The innovation lifecycle includes the classical product lifecycle (PLC) [13], preceded by a hype phase [14], and it is an important concept because this lifecycle manifests the timing and framework within which technology transitions to the marketplace. University innovators, in particular, need to be aware of their early position in the innovation lifecycle, as their roles and experience are often less well suited to driving the technology successfully through the entire cycle. The reasons for this relate to changes that occur as a technology is translated from research into a commercial activity, including: changing skillsets, a transition in work force culture, ever expanding funding requirements and increasing misalignment between a university innovator's goals as an academic and the needs of the company. Research skills and emerging scientific trends are paramount for success at the beginning of the cycle; however, a rapid transition then occurs to product development, marketing skills, business development skills and finally operational skills in order to establish a successful company. Work force culture also changes dramatically from a high risk, innovation culture at the beginning of the translational process, to a low risk operational environment once a company is established. Finally, funding sources also transform during the process, from predominantly high risk government research funding in the very early stages of the cycle, to lower risk grant funding during the 'Valley of Death' [15], to later stage venture funding during the growth of the company and finally to public markets or large acquiring companies with low capital costs. Historically, while venture funding was also available in the early stages of the cycle (during the hype phase), in the physical sciences that funding has now largely transitioned to later stages in the cycle (growth phase). This funding trend has had a significant impact on universities as they can now no longer rely on venture funding to support (or take over) translational work early in the cycle.

Figure 1. The technology/company lifecycle, including a hype phase and a classical product life cycle phase.

Download figure:

Standard image High-resolution imagePerhaps the most important aspect of the lifecycle is the relative scale of the time axis. Some sectors—for example, information technology or consumer electronics—can move through the cycle very rapidly, on the order of months or one–two years; other sectors—material science, clean technology and biotechnology—move through the cycle very slowly, on the order of many years, reaching into a decade or more. Furthermore, slow-moving sectors tend to be much more capital intensive, leading to extra financing burdens. Unfortunately, many of the most compelling innovations at universities fall into this latter category.

2.2. Two lab-to-market examples

Typical physical science companies require three–ten years for the concept stage alone. Examples are shown in figures 2 and 3. Figure 2 shows the story of Cronos, a venture-funded company in North Carolina, USA, which achieved a very successful exit (one of the authors, von Windheim, was VP of marketing; acquired by JDS Uniphase). The timeline illustrates the challenge of timing in moving a new technology platform (Microelectromechanical Systems—MEMS) into the market place. This 18 year timeline does not include the many years of more basic MEMS research that preceded launching the effort that became Cronos. Financial success for the founders and investors took eight years; full product success took 18 years. The Cronos case study is reviewed in more detail in the discussion of the process and metrics section of the lab-to-market roadmap.

Figure 2. The Cronos story.

Download figure:

Standard image High-resolution imageFigure 3. The Zenalux story.

Download figure:

Standard image High-resolution imageIn another example, figure 3 shows the story of Zenalux Biomedical (von Windheim is CEO), also a company that is commercializing a university technology. From invention to first product sales for preclinical applications took 12 years; given the nature of the invention (a medical device to monitor therapy and for cancer detection), it will still take a few more years to achieve full commercialization.

Other examples well known to the authors include Unitive Electronics (von Windheim was business development manager at founding; acquired by Amkor) and Nextreme Thermal Solutions (von Windheim was CEO; acquired by Laird Technologies); both of these were based on new materials developments and had similar timelines to Cronos and Zenalux. The bottom line is that translational success, by any measure, can take a very long time in the physical sciences

2.3. Trends in venture capital

It is important to note that neither the Cronos nor Zenalux effort suffered fundamentally from lack of funding—each had significant grant support, and Cronos also ultimately secured the venture funding it needed to be successful.

Nevertheless, the funding landscape has become increasingly challenging for start-ups, with a significant impact on the traditional university commercialization pathway for new innovations. For the most part, the traditional university approach has been to invent something world-changing and then to rely on venture groups to commercialize it in an 'over the transom' model (figure 4).

Figure 4. The traditional university commercialization model ('over the transom').

Download figure:

Standard image High-resolution imageWhile this model was certainly valid in the 1990s and was somewhat valid up until 2008, the venture ecosystem has shifted considerably in the last decade. Data for 2006–11 is shown in figure 53. Clearly, the venture capital industry has undergone contraction. Whether this is permanent or not is an important question for start-up activities. However, just as important is another trend, consolidation: for example, in Q2 of 2012 $5.9 billion (USD) was raised by venture capital firms; of those funds, almost 80% went to only five venture capital firms, primarily located on the US West Coast.

Figure 5. Trends in the venture capital industry (data source: National Venture Capital Association).

Download figure:

Standard image High-resolution imageThus, the venture capital industry is not only shrinking in size, but is also consolidating; in other words, showing all the signs of a maturing or even declining industry. With consolidation, the remaining larger firms make larger investments and accordingly fewer seed and early-stage investments. One can argue about the reasons for this, although it would seem likely that it is an indication that venture returns in early-stage technology currently do not justify their risk and illiquidity relative to other asset classes [16]. To some extent, venture firms have responded to this lack of performance by moving downstream to less risky investments, leaving seed funding to 'angels', philanthropy and government, and thereby creating a funding gap in series A and B investments [17].

Independent of the forces that are driving these capital market trends, the impact is clear: it is more and more difficult for science-based start-ups to raise venture funds; this is especially true for early-stage activities. Michael Greely concludes that while it is feasible to raise seed stage funding through friends and family and angel networks, follow-on funding (series A and B, the larger investment needed to build a pre-revenue or at least pre-profit company) is going to continue to be very hard to come by.

3. The lab-to-market roadmap: a framework for solving the early-stage problem

3.1. Overview

The timing challenges, the skills and cultural challenges, and the relative paucity of early-stage venture capital funds invite the question how does a university create a robust entrepreneurial platform that can build value off of a huge pool of intellectual capital? We hypothesize that the answer is that a disciplined translational infrastructure must be established. This approach includes both licensing and entrepreneurial strategies with the ability to discern which innovations are better served by one approach or the other. In that regard, creating an environment at the university in which this entrepreneurial effort is closely aligned with both intellectual property generation and the technology transfer office is requisite for success. Moreover, this infrastructure must be executable and fit within the existing ethos of the organization that is carrying out the translational work. At universities this means that translational work must be compatible with the school's primary research mission. Finally, the infrastructure must take into account that funding is constrained—that is, only the very best opportunities have a chance of being funded, and start-up capital may not come from traditional sources. In institutions that have competitive internal translational funds, linking the entrepreneurial effort to those programs and the project leadership they offer also provides much needed capital and oversight to pre-company efforts.

To start, consider the critical success factors that presage a successful translational program. These are as follows.

- Process—a robust, yet simple process that is teachable to students and faculty. The process needs to be cash efficient and fit easily into the organization's educational and research culture.

- Education—a compelling educational program consistent with the mission of many organizational units so that students and faculty across multiple disciplines and even across a significant length of time are able to share perspective on the process and its outcomes.

- Infrastructure—most importantly, an infrastructure has to be in place that facilitates education, communication and allocation of translational resources, where available. It is particularly critical that the infrastructure accommodates a wide range of participation, including from instructors, students, faculty, investors, mentors, service providers and community participants.

We discuss these critical success factors in detail below.

3.2. Defining the process

In the physical sciences, technology evolves with an overall predictable timeline (table 1) and a highly chaotic selection process. Selection is driven by technology readiness and market readiness, both of which are highly unpredictable, particularly in the concept and seed stages of the technology timeline. A successful process for early-stage technology commercialization must take into account the technology timeline and the inherent unpredictability of the selection process.

Table 1. The technology timeline in the physical sciences.

| Participants | Technology stage | Increasing value | Timing | Company building |

|---|---|---|---|---|

| Universities | Theory |  |

Decades | |

| Universities | Fundamental research | Decades | ||

| Universities | Technology development | 5–10 years | Concept | |

| Universities, start-ups | Proof of concept | 1–2 years | ||

| Universities, start-ups | Prototype | 6 months | Seed | |

| Start-ups, corporations | Alpha product | 6–12 months | Start-up | |

| Start-ups, corporations | Qualification and Manufacturing | 12 months | ||

| Corporations | Product extensions | 2 years + |

At a high level, consider a process that separates the timeline into three major stages for early-stage commercialization: concept (ideation and proof of concept indicating research has product potential); seed (first product prototype); and start-up (product development). These stages are generally well known and correspond to crucial inflection points within any commercialization activity. Within the timeline, the concept and seed stage are poorly funded and very chaotic—these are the phases that, for the most part, must occur on the university platform as venture funding is unlikely to be generated [17].

At a more granular level, and independent of the chaos that is normally present during the concept and seed phases, there are six important activities that take place as an idea moves through each of these stages. These activities are very consistent for any start-up development and need to be carried out in some form or fashion regardless of technology.

The six activities are as follows.

- 1.Concept validation

- Validate scientific data through peer review, ideally in the most prestigious journals.

- 2.Technology validation

- Create a technology demonstration vehicle within the lab that shows a physical demonstration of the science.

- 3.Market validation

- Validate technology demonstration with industry experts and customers who can speak to the value of the technology. Ideally, generate orders from customers.

- 4.Prototyping

- Validate working prototype with application thought leaders and customers who can confirm the value of the technology. Ideally, customers are paying for prototypes.

- 5.Product development

- Create robust, reproducible, functional product for customer testing and feedback.

- 6.Company building

- Start-up operations and growth with professional investors who can help maximize the potential of the company.

Generally, if translational teams follow these steps in a disciplined fashion, and if they are open to failure (which is much more likely than not) then over a period of time, with a portfolio of technologies, success will be realized. Importantly, given the time that the process takes, it may require several iterative efforts by multiple teams before success is realized. This is perfect for organizations that have both the human resources (e.g. students, postgraduates and faculty) and the portfolio available to execute such a process.

3.3. Process metrics

In conjunction with these activities, the early-stage start-up process also involves a fundamental, iterative cycle of improvement that continuously advances the opportunity in five key metrics. These metrics are:

- team;

- technology;

- market;

- revenue/customers;

- ability to execute.

Ideally, the improvement cycle around these metrics is carried out by the principals who are championing the opportunity—i.e., innovators themselves. The cycle involves: evaluating an opportunity in each of the five metrics listed above; getting external validation on the evaluation; analyzing the evaluation and the validation results; identifying improvements (or killing the project); executing the improvement plan; and repeating the cycle (figure 6). As the team iterates forward in this cycle, they should also be moving forward within the six activities that comprise the start-up process.

Figure 6. As the start-up process is carried out, metrics are constantly reviewed with the goal of improving the opportunity or killing it.

Download figure:

Standard image High-resolution imageIt is important to realize that the weight of each of these metrics, and even the characteristics of the metrics themselves, will evolve as the opportunity evolves through the six activities identified above. For example, at the concept activity a highly qualified team might consist of a world-renowned academic and some graduate or post-doctoral students. However, in the later stage activities, such as product development or company building, a more balanced team with strong business experience in the domain of interest would be required. And while customers and revenue are not so important during concept development, they become increasingly important after the technology has been validated.

While the market is a critical metric at all times in the process, market validation does not occur until a prototype can be built—this is because it is very risky to try to validate a market with nothing to demonstrate to the potential customer. At the same time, in the very earliest phases of technology development, where grant funding is available, market forces should not be a major driver in decision making as it is impossible at that stage to determine the 'market' for a yet-to-be developed (and therefore undefined) technology.

3.4. Education

It remains the charge of the research institution and its mission to create great innovators, not necessarily great start-up CEOs; however, without understanding the lab-to-market roadmap, faculty and students cannot execute the translational process and are challenged to learn (and continually relearn) a process by trial and error. Therefore it is vitally important to educate the students and faculty about the process and how they might go about executing it. In order to be successful, prospective entrepreneurs need to be effective in the following areas.

- 1.Technology validation

- Ensure, using the best scientific methods, the most compelling demonstrations, and good intellectual property protection, that the technology is unique and compelling.

- 2.Market validation

- Evaluate the market situation.

- Identify a value proposition.

- Validate value with the market/customer base.

- Identify a practical implementation path (product and business model).

- Execute.

- 3.Company formation.

- Ensure that the company is set up with the right capital structure, infrastructure and management team to succeed.

As an opportunity moves from concept to seed to start-up, the most critical steps of the company creation process are in technology validation and market validation. This is where great technologies often iterate back and forth until a fundable and marketable value proposition is discovered (or not). Unfortunately this is also the area that is known as the 'Valley of Death or 'chasm' (figure 1). At this stage there is little funding and key skillsets are often missing in teams that have the core technology knowledge. Consequently, concepts may be delayed here for a long time as technology validation and market validation demand technology changes that are not easy to implement.

Meanwhile, although technology validation comes easily in the university environment, market validation does not. It is in fact paramount that academic organizations position themselves to focus on market validation, especially with their best technological innovators. In particular, the infusion of business development activities (i.e., seeking customer acceptance of technology advances and prototyping efforts) is the most important challenge facing universities in their technology translation activities. In that regard, the educational mission, translational seed funding and technology licensing process must be as well-aligned with this focus. Learning to decline to support projects is challenging in academia; using customer metrics (market validation) to decline support is perhaps even more challenging. However, the alternatives are underfunded attempts to commercialize everything, thereby diluting the limited funding and available expertise required for a successful process.

3.5. The lab-to-market roadmap

With process, metrics and education in mind, the basic structure of the translational process is shown as a lab-to-market roadmap in figure 7. It is worthwhile to emphasize again that this process and approach is designed for innovations in the physical sciences; it is not meant for information technology innovations (for example, social networking), which typically operate on a fundamentally shorter timeline, often with lower resource requirements and less dependence on fundamental scientific breakthroughs.

Figure 7. The lab-to-market roadmap: process, metrics and education are outlined as a technology moves from lab to market.

Download figure:

Standard image High-resolution imageIn this model, a series of simple but well-defined translational steps are consolidated and combined with key metrics and classroom education to achieve a disciplined, low cost translational approach that can be programmatically implemented in an academic institution.

Core to this process is education: students and faculty are trained in key aspects of technology validation, market validation and company formation. Classes are in large part taught by experienced entrepreneurs and start-up professionals. Importantly, this is not just an educational exercise: real start-ups are expected to be developed off of the university technology platform (Zenalux Biomedical (figure 3) is an example). New companies that mature to have outside capital and professional management are not only an important metric for the program, they also provide a practical laboratory in which the best students can apply their newly developed skills.

Note that, although 'university entrepreneurship' covers both the concept and seed stages in figure 7, only the concept stage is directly consistent with the university core mission of research and education. At the seed stage it is highly likely that the translational effort will need to be transferred to an independent platform, while the interaction with the university remains strong (see figure 3, the Zenalux story).

4. A case study in process and metrics: Cronos Integrated Microsystems

Cronos was a success during a unique period when company valuations were being driven up by a bubble in the telecommunications market. Nevertheless, Cronos represents a good case study on the principles of process and the metrics discussed herein.

In 1997 Cronos was still known as the MEMS (micro-electromechanical systems) Technology Application Center (MTAC) at the Microelectronics Center of North Carolina (MCNC). MCNC had been funded by the state of North Carolina, USA, in the 1980s to create a leading-edge integrated circuit manufacturing facility. While MCNC's capabilities were world-leading at inception, by the early 1990s the semiconductor industry's rapid evolution had left MCNC with aging equipment and no further funds to upgrade.

MCNC's solution was to reposition the equipment and facility for MEMS fabrication and, with the help of funding from DARPA, MCNC was able to develop a world-class capability in this area.

One of the authors (von Windheim) joined MCNC in 1997 as the business development manager, responsible for finding commercial outlets for its technology. Twelve opportunities were identified: five of these were down-selected; from these five, four companies were generated; two of these companies (Unitive Electronics and Cronos) resulted in successful exits and are still operational today.

Applying the five core metrics to MTAC revealed an exceptional opportunity that later became Cronos. The MEMS team assembled at MCNC was world class by any measure, consisting of over 15 engineers and technicians who represented the very best in MEMS design and process experience. The team leader, Karen Markus, was world renowned and had the distinction of being referred to as the 'queen mother of MEMS' in the journal Science [18]. However, for all of its technical strengths, MTAC was actually poorly positioned to execute the lab-to-market roadmap. Specifically, MTAC was poorly positioned to move beyond technology validation. MTAC had no market validation skills and had no mechanisms to ensure that prototypes (which it could produce at will) were in fact market oriented. Beyond that, the organization was not prepared for product development or company building.

From a pure technology perspective, the platform at MCNC was also unparalleled. MTAC was perhaps the only organization in the world that offered all three MEMS processes: surface micromachining, bulk micromachining and LIGA (Lithographie, Galvanoformung, Abformung). The team had developed a service called Multi-User MEMS Process (MUMPs), whereby users could very inexpensively prototype and carry out pilot production in the MCNC fabrication facility. However, a weakness was that none of the technology, including MUMPs, had been geared towards a specific market opportunity. With a focus on design and process development at MTAC, little thought had gone into scaling the effort into a high-volume, high-value business.

The overall market opportunity seemed immense, both in terms of scale and scope (figure 8). However, MTAC's problem was that it had not aligned itself with any specific growth opportunity. Its main business was design and fabrication services, a business that benefited from the overall market expansion, but did not necessarily represent a long-term, high-value growth opportunity.

Figure 8. In 1997 the MEMS market was predicted to grow exponentially, driven by a wide range of new products that would benefit from the technology4.

Download figure:

Standard image High-resolution imageWhile the majority of MTAC's revenue was generated through government contracts, it also had an emerging commercial customer base (figure 9). These customers were using MUMPs to evaluate many different MEMS ideas. The weakness in this revenue base was that many of these customers were in academia and start-ups, and they were not in a position to move beyond prototyping; however, the fact that there actually were commercial customers and that total revenue exceeded $4 million (USD) in 1997 was impressive nonetheless.

Figure 9. Revenue at MCNC/MTAC through 1997.

Download figure:

Standard image High-resolution imagePerhaps MTAC's biggest strength lay in its ability to execute. The organization had a fully facilitated fabrication capability with the right personnel to carry out almost any MEMS fabrication challenge that was presented to them. While MTAC was not yet positioned for production, this was primarily a skills problem that could be resolved through hiring.

In addition to evaluating the opportunity relative to the five key metrics, it is also important to understand where it falls within the process outlined in figure 7. In the case of MTAC, the technology had clearly been validated, as evidenced by its increasing acceptance by both government and commercial customers (figure 9). Furthermore, a prototype service had been created, namely MUMPs. Yet, while MUMPs was a tremendously valuable prototyping tool (and remains so to this day5), it could not be validated as a high growth opportunity and MTAC failed to gain traction as it tried to raise venture funding to fully commercialize the service. Overall, it was quite clear in 1997 that, while MTAC had done a tremendous job of executing the first half of the lab-to-market roadmap (especially through technology validation), it was contrastingly poorly prepared to execute the second half.

The six-step process and the metrics are designed to create a framework for identifying weaknesses and setting actions that will either move the opportunity towards success or cause failure (figure 6). With respect to MTAC, weaknesses on the team were addressed by augmenting the technical team with business and manufacturing experience—an effort funded at first directly by MCNC. This effort was increased as money was raised. Furthermore, while the technology platform that existed was maintained, a renewed focus was put on productization, including filing and licensing of product patents. Most critical, however, was that prototyping was accompanied by market validation by way of testing for customer acceptance and ultimately winning customer orders, even at the prototype stage. A first effort involved the development of a microrelay that gained interest from numerous, significant customers, including Nortel Networks. This product and the interest it generated was enough to raise venture funding and lead to the formation of Cronos; however, the microrelay never made it to the product development stage in figure 7 because it could not be validated in the market with customer orders.

It can be frightening for a team if a prototype is not validated in the marketplace, especially when a great deal of effort has gone into development. Nevertheless, failure at market validation is the norm not the exception. Many teams in this case will endeavor to improve the technology in an effort to gain market acceptance—there is almost always another customer specification to meet that might lead to acceptance. A better approach is to accept the market signal that a prototype is not gaining traction and pivot the technology into other directions, ideally with customer direction. If the technology has truly been validated as being unique and valuable, then it is highly likely that there will be more than one application for the technology and a pivot into a new direction will be quite feasible. Unfortunately, this is where funding sources are weakest: venture capital is unwilling to back an effort with significant market risk; at the same time, government agencies are typically unwilling to fund beyond technical validation.

Fortunately for Cronos, MCNC provided the critical early support, giving the company the opportunity to ultimately pivot once more to optical attenuators and optical switches. These immediately gained market validation in the form of significant customer orders, even at the prototyping level. The company was formed in 1998 (based on MUMPs and other services), gained venture backing in 1999 (based largely on the microrelay) and was sold to JDS Uniphase in 2000 for $750 million (USD) on the basis of its dominance in MEMS photonics products and services.

The timeline for Cronos is shown in figure 2. It took five years to validate the technology platform (ten years if the initial effort to set up the fabrication facility at MCNC is counted); it took another three years to iteratively move through several prototyping/market validation efforts; and another three years after that were spent completing product development and fully establishing products in the market. The company could easily have never seen the light of day. Its success hinged on patient DARPA funding and MCNC's early support as the team iterated back and forth during the market validation phase.

In the context of trying to develop a general translational model, it is important to note that MCNC was not a university; the organization was a non-profit research institute that did not have the educational or fundamental research missions that universities have. Consequently, the organization was positioned to move the technology much further into the seed stage than could be expected at a university (figure 2, the Cronos story). Nevertheless, the roadmap remains the same and organizations that want to be successful at technology translation will need to find ways to adapt to it.

For the university environment, Zenalux (figure 3) is perhaps a more direct example in that it is a university spin-off. Zenalux is not discussed in detail here, but its trajectory and the iterative process it is following to meet a real market need closely follows that of Cronos, although the ultimate outcome is yet to be realized.

5. Infrastructure and funding

This leads us to the importance of infrastructure (including the funding infrastructure) in executing the lab-to-market roadmap. Operational management of the early-stage commercialization infrastructure is as complex as the projects themselves. The challenge for any organization that wishes to commercialize early-stage technology is to develop a framework that addresses all the issues discussed above, thereby consistently moving technologies through their early lifecycle. Critical in this is that projects cannot languish in the pipeline—or at least they should not consume scarce resources (funding and human capital) without a clear path towards success. Thus, it is very important to establish a system that moves projects along in a disciplined fashion, or discontinues support based on pre-established criteria and processes. At the same time, the system cannot be rigid, as this will block innovation as surely as doing nothing at all.

Such a system poses a unique management challenge because a set of complex projects, all at different stages in their lifecycles, have to move seamlessly through the pipeline. Care needs to be taken to ensure that the operational responsibility and control is transitioned smoothly through the entire technology timeline. Excellent companies are very good at achieving these transitions; academic environments, 'non-profits' and government agencies are often not.

One approach to selecting projects for management and advancement is to identify and overlay funding sources on the lab-to-market roadmap shown in figure 7; this has been done in figure 10. Figure 10 also provides more detail on specific training activities that should be offered as teams move their technologies through the roadmap. Only programs that can articulate this kind of successive funding and educational pathway should be resourced.

Figure 10. An example of an operational infrastructure that helps guide an entrepreneurial process without impeding creativity in the early stages. The product lifecycle (figure 1) and lab-to-market roadmap (figure 7) are shown as overlays.

Download figure:

Standard image High-resolution imageUnfortunately there is no single solution for establishing the optimal operational infrastructure. The reason is that, like the commercialization opportunities themselves, every situation is different and entirely dependent on the underlying technology organization. A university, with a huge number of research projects and concepts and a strong motivation to train students, probably has the least amount of direct control (and the least funds directly available) to implement a commercialization framework. A commercial entity that is trying to manage its innovation process has the most complete control and will likely have the most funds available.

Nonetheless, while the method of managing operations may vary, the underlying roadmap can and should be the same. For universities, focusing on the roadmap, while also ensuring that the appropriate training and funding is available throughout the roadmap, may be a highly effective approach to managing their intellectual property portfolios. And while commercial entities might look to professional teams to manage this process, there is no reason that universities and even companies cannot draw upon the strengths of their technical staff, project leaders and even students to manage at least the early stages of the commercialization activity.

For funding sources, universities and their faculty are very competitively positioned to win government grants. In some case, universities are also uniquely positioned to gain endowments to help support the translational process. Finally, faculty at universities are also competitively positioned to win small business grants that have the potential to supplant traditional seed funding for start-up activity.

6. A lab-to-market case study: Duke University

The infrastructure described above has been successfully implemented at Duke University (figure 11) with a focus on biomedical technologies. Built originally as an educational effort to advance innovation, the program has since secured an endowment that maintains an annual commitment of $1 million (USD) to support translational research, as well as providing funds for prototyping activities and value-creating milestones (see concept fund in figure 10). The key aspect of this program, however, remains education and project leadership. Entitled innovation-to-application (ITA), the program focuses on graduate level students (MSc, PhD, MD, JD, MEM, MEMP) with the goal of teaching them how to identify and nurture promising biomedical technologies at Duke. ITA teams spend a year working hand in glove with the licensing and ventures office at Duke to identify and then down-select promising technologies; develop plans for lab-to-market execution; and in some cases go on to implement those plans in start-up activity (seed stage in figure 7) that operates independently from the university and is created in an arms-length transaction. In many cases projects do not make it through to the seed stage; however, in some of these cases the support provided to gather data in technology validation and early market validation has been an important component in making the case for additional grant funding for further development. The program has been offered in engineering, business and medicine, and the educational component has recently been expanded to the School of the Environment as a certificate. In the first eight years, successes attributed to these programs include:

- over 70% of funded projects have moved into clinical research;

- $145 million (USD) in follow-on funding (angel funding, venture capital and federal funded grants) has been generated for program-backed technologies;

- successful companies include PhaseBiosciences, Cytex, Cerenova and Zenalux Biomedical.

With this degree of follow-on capital, the return to the university (indirect cost recovery) is substantial and offsets the commitments made to create the program. Furthermore, the endowment model ensures that there is very little downside risk in the seed capital that is applied to these projects. Thus, with very little capital at risk, successful implementation of the lab-to-market process leads to 'returns' in the form of enhanced follow-on capital, while at the same time delivering a very significant upside potential through the formation of successful companies. Overall, the approach demonstrated at Duke appears to offer a low-risk, high-reward pathway for technology valorization within universities. While the situation at Duke may be unique in that the funding was specifically endowed to support the metrics cited above, we hypothesize that similar successes can be achieved at other universities and with other innovations within the physical sciences if the same model is applied, including innovations in materials science and clean technology.

Figure 11. A practical implementation of the lab-to-market infrastructure at Duke University.

Download figure:

Standard image High-resolution image7. Summary

Translational activity in the physical sciences must account for unique challenges in timing, skills evolution, changes in workforce culture and funding. In particular, a lack of appetite in the investment community for early-stage, capital-intensive projects has reduced start-up activity in technology-rich/capital-poor organizations. To address these challenges, a disciplined process (roadmap) should be implemented in which students and faculty are engaged in a continuous fashion over long periods of time to move the most promising projects towards real commercial activity. An important aspect of this approach is to measure progress according to key metrics (team, technology, market, customer/revenue and ability to execute) and to ensure that participants are effectively trained in technology validation, market validation and company start-up operations. The most important of these activities is market validation, and it is an area where universities in particular need to shore up capabilities in order to ensure success.

A disciplined approach to advancing only the most promising technologies is central to success in a resource-starved environment. Such a program can be well aligned with the strengths of the university, and has the potential to move universities away from an 'over the transom' approach to an environment where promising technologies are nurtured and translated with long-term success in mind, generating meaningful returns at low risk to the institution, the region, its students and its inventors.

Footnotes

- 3

This data was sourced from a blog by Michael Greely 2012 'The Slog Continues...'.

- 4

From the Cronos Integrated Microsystems business plan.

- 5