Abstract

The remarkable properties of graphene and related materials (GRMs) promise substantial benefits for a wide range of technologies. Their industrial utilization, however, critically depends on the availability of suitable GRM supply in terms of both quality and quantity at a competitive price. All factors remain highly specific to the each application scenario, while the emerging GRM supply industry still struggles to engage prospective clients in active development of GRM-enhanced products. The present issue of Graphene Roadmap Briefs compiles results on the status and prospects of GRM industrialization gathered by several innovation interface investigations (3I) that we conducted throughout the past 3 years. Each 3I study focussed a unique prospective value chain that GRM innovation promises to enable or advance in the future. While individual roadmaps mainly cover the peculiarities of the specific GRM supply chain under investigation, we combine all results regarding the primary material supply sector and it is rapidly evolving innovation context in Europe and beyond here. We introduce both the initial 2018 graphene industrialization roadmap and its thorough 2020 revision and extension. Our conclusions cover both crucial factors hampering the diffusion GRM today and opportunities to overcome these bottlenecks in the future.

About: Graphene Roadmap Briefs

Graphene Roadmap Briefs highlight key innovation areas impacted by graphene and related 2D materials (GRMs) as well as overarching aspects of GRM innovation status and prospects. The series bases on the evolving technology and innovation roadmap process initiated by the European Graphene Flagship. It covers crucial innovation trends beyond fundamental scientific discovery and applied research on GRM utilization opportunities.

Export citation and abstract BibTeX RIS

Original content from this work may be used under the terms of the Creative Commons Attribution 4.0 license. Any further distribution of this work must maintain attribution to the author(s) and the title of the work, journal citation and DOI.

List of acronyms

| GRMs | graphene and related 2D materials |

| TIR | technology and innovation roadmap |

| 3I | innovation interface investigation |

| S&T | scientific and technological |

| GO | graphene oxide |

| rGO | reduced graphene oxide |

| CVD | chemical vapor-phase deposition |

| EGG | electronic-grade graphene |

| TMDCs | transition metal dichalcogenides |

| ALD | atomic layer deposition |

| MBE | molecular beam epitaxy |

| MOCVD | metalorganic chemical vapor deposition |

| GNP | graphene nanoplatelet |

| EHS | environment, health, and safety |

| REACH | Registration, Evaluation, Authorisation, and Restriction of Chemicals |

| TRL | technology readiness level |

| R&D | research and development |

| OEM | original equipment manufacturer |

| KCC | key control characteristic |

| KPI | key performance indicator |

| SME | small and medium enterprises |

The list of abbreviations and acronyms excludes proper names, common use (such as 2D), metric system units, chemical symbols, and isolated introductions (for terms most common as acronym such as CNT).

1. Introduction

The practical isolation of graphene in 2004 [1] sparked enormous expectations in terms of scientific discovery, technological application opportunity, and potential economic value. Properties, that merely existed in theoretical concepts [2] before, suddenly materialized. Long sustained growth in both scientific publication and patent application records [3] based on GRMs evidence significant momentum often seen as hype [4].

Of course, the translation of a novel material into widespread economic impact takes substantial time spans [5] and present market developments appear to lag behind initial expectations. Roadmaps provide a mechanism to aggregate the foresight of key experts and, thus, guidance to the greater community of potential stakeholders.

The Fraunhofer Graphene Roadmap Team formed in the context of the European Graphene Flagship [6] to expedite the continuous TIR process. We described the context of its evolution in the inaugural issue of Graphene Roadmap Briefs [3], particularly discussing the merit and scope of different roadmap approaches. In contrast to traditional S&T roadmaps [7], Graphene Roadmap Briefs entirely focus on the status and prospects of GRM-enabled innovation, with each issue dedicated to a specific branch or general aspect of the extensive and still emerging GRM innovation system. In general, the latter not only spans various 2D materials and their diverse applications, but also direct and indirect utilization potentials, including possible future impact down to economic and societal scale levels.

The present issue covers the status and prospects of GRM industrialization derived from several topic-specific 3I [3] we conducted over the past 3 years. In particular, we focus on the emergence of a GRM supply industry including the prospects and obstacles for its growth and further development. We first provide a coarse overview of GRM categories most relevant for our roadmap work below. The roadmap discussion itself is then structured in three sections reflecting the evolution of both the GRM supply industry and our roadmap work covering it over the past 3 years. In 2018, we first aggregated a roadmap on the overall status and prospects of GRM industrialization from an initial set of four topic-specific 3I studies. Thereafter, six further 3I studies conducted over the past 2 years substantially enhanced both breadth and depth of our consolidated analysis. We first discuss the impact of roadmap time horizons and their relation to the passage of time between different analyses, before introducing the current GRM industrialization roadmap 2020.

2. Graphene and related materials in industrial context

Fundamentally, graphene identifies a single, freestanding monolayer of carbon atoms arranged in a strictly two-dimensional hexagonal lattice. In practice, only high-quality electronic-grade materials may come remotely close to such a narrow definition.

A small segment of the supply industry targets exactly this high-value market niche. As its innovation context differs substantially from bulk supply, we limit our discussion to a brief status description below and intend to cover our full roadmap results for that specific segment in a forthcoming issue of Graphene Roadmap Briefs.

Despite contradicting the definition of ideal graphene, particles with multiple layers, limited lateral extension, chemical impurities and/or deliberate functionalization may still feature some unique or advanced properties compared to bulk graphite and conventional carbon materials such as carbon black or activated carbon. In fact, the differentiation (graphene vs. no graphene) is subject to scientific debate [8].

Here, we adhere to the generalized category of GRM, which broadly encompasses not only any other 2D material (to which graphene is considered archetypal), but also various (carbon-based) derivatives of graphene. At present, the emerging GRM supply industry largely focusses the latter. In this sense, we effectively employ both terms, 'graphene' and 'GRM', as synonyms for carbon-based 2D nanomaterial 1 types intended for bulk production and utilization throughout this article. We highly recommend the rich scientific literature for an overview on earlier definition attempts [9] and current consensus, in particular as summarized in review articles [10] and scientific roadmap formats [7]. On the long term, international standards and effective methods for their validation (such as the dedicated measurement technique standard [11]) will eventually provide sufficient clarification in application context.

In the following, we provide a brief overview of properties and categories of GRM that often became relevant in our past roadmap initiatives. This overview documents the common level of understanding of the subject matter as shared among a vast majority of involved experts (mostly from industry) at the time of analysis. It may well serve as a first introduction for readers new to this field of interest, in particular when interested in the practical aspects of GRM utilization. However, scientific review articles such as those referenced above may serve as better entry points to obtain a balanced overview of the scientific state-of-the art and relevant technical details. We highly recommend such complementary literature. We provide some specific content references below, in particular in case of their explicit use in our consultation process [3]. Note that all further content represents either common knowledge (among experts in the field) and/or our aggregation from confidential expert consultations.

2.1. Most relevant material properties

Two-dimensional materials exhibit exceptional physical and chemical properties unobserved in bulk materials. Graphene, as the most prominent representative of this class of materials, has a very high electrical conductivity (~108 S m−1) due to its high intrinsic charge carrier mobility—theoretically outperforming that of many other materials. While the charge carrier density in pristine graphene is comparably low, it can improve significantly through doping or electrical bias. Although charge transport along the 2D plane can be severely hindered by defects, conductivities on the order of 105 S m−1 can be achieved by exfoliated flakes on a substrate [12], while higher values are reported for suspended graphene [13]. Similarly, graphene also shows remarkable thermal conductivity [14].

The chemical structure of the sp2-hybridised carbon atoms in graphene and the resulting electronic structure render the material to be very strong (tensile strength of 130 GPa and a Young's modulus of 1 TPa) [12] and, due to its thickness of only a single atom, flexible at the same time. If embedded in matrix materials such as polymers, their tensile strength and robustness may increase significantly. With its 2D-nature and the light atomic weight of carbon, graphene powder can have a very high specific surface area of more than 1000 m2 g−1. For rGO, values of several 100 m2 g−1 are reported [15]. These values strongly depend on the preparation route and stabilization of flakes as clumping or re-stacking can decrease the accessible surface area and have a severe influence on the micro-porosity of resulting powders. Depending on the desired powder properties, the addition of spacers or templates during the production process or the synthesis of crumpled or curved flakes can be necessary.

The ability to functionalize graphene multiplies its versatility. In general, its extreme surface-to-volume ratio presents enormous opportunities in terms of both, primary interactions during the application of functionalization agents and secondary interactions of the functionalized device with its environment, as intended for sensing purposes. Fundamentally, edge sites are favored for the covalent attachment of functionalization agents, as the perfect sp2 configuration of on-plane (basal) sites typically limits external bonding to van der Waals-type interaction as well as intercalation within multi-layered graphene flakes. However, systematic covalent attachment to basal surface sites shows a lot of promise for future applications. Some dedicated chemical approaches such as graphite fluorination open c–c bonds on the basal plane and, thus, enable covalent bonding onto the plane. In practice, oxygen sites in GOs or intrinsic defects in rGO offer systematic interaction potential. In general, many alternative concepts for the functionalization of pristine graphene exist already or are in development.

2.2. Industrial-scale production

Due to their excellent physical and chemical properties, GRM are considered enabling materials for many new applications in almost all fields of technology. So far, GRM have found initial commercial application as an additive in bulk composites, inks, coatings or electrode materials. In these cases, it is often valued for its mechanical strength and/or high electrical conductivity, but also for chemical inertness, anti-microbial or flame-retarding properties, etc. Few high-tech applications exist as well. However, these usually only require tiny amounts of graphene on a gravimetric scale, but often entirely different material quality (see below).

Although graphene production grows rapidly, significant market penetration has not occurred in any field yet. For most applications, graphene will remain in a research and prototyping phase for the next years. The low level of commercialization in bulk applications corresponds to a low global material demand level. Despite low visibility, our meta-market analysis [3] estimates that the present global demand probably ranges still well below 1000 tons yr−1 (for 2020). A high degree of uncertainty remains even for historic data. Most likely, the demand accumulated to 50–100 t a−1 in 2018 and reached 300–400 t a−1 today. Market projections foresee demand growth to pick up in the early 2020s and surpass the kt yr−1 mark then. The global production capacity, however, likely surpassed the kt a−1 mark already in 2016 and reached up to 2.5 kt a−1 in 2018. Major production facilities are located in China at the moment, but experts dispute the material quality claimed by many Chinese sources (often rather supplying graphite nanoflakes than graphene). In general, graphene producers are itching for large-scale application opportunities to charge and expand their capacity.

The present status of the global graphene supply industry is characterized by the following major trends:

Steady demand growth: industrial utilization and, thus, sales of graphene increase substantially, but at a rate resembling the bottom end of earlier expectations.

- Stagnation of global production capacity: aggregated numbers likely stay constant as typical reductions of past overcapacities balance the expansion of individual producers.

- Slow decay of production cost: producers clearly target unit cost reductions, but immediate reduction potentials remain limited without substantial volume expansion.

- Pricing strategy: aggressive price levels and targets exist in the market, apparently undercutting sustainable costs [16]. Rationales may include economic pressure to at least generate marginal returns and conscious strategies (grow the market or gain market share first) to overcompensate current losses with future surplus.

- Quality improvement: marketing and sales highly depend on quality and consistency of graphene products. Individual producers and community alliances currently achieve major progress in that regard.

- Market consolidation: the present phase is characterized by limited nominal (in terms of financial market volume of sales), but substantial qualitative (in terms of customer value) progress. The industry currently creates a solid foundation for future growth, while a major market shakeout may occur in case the aspiration period persists.

2.2.1. Production paths and supply streams

Suppliers attempt to commercialize various pathways of graphene production. Bottom-up methods mostly rely on CVD of carbon-rich compounds, to form 2D sheets of carbon. The obtained quality of bottom-up graphene is typically high, however, these methods are not easily scalable and rather costly, hence they are prone to high-tech applications (briefly discussed below).

In contrast, top-down methods, for instance via the chemical exfoliation of bulk graphite, are much cheaper and more scalable techniques. Due to the low yield of direct graphite exfoliation, many larger scale synthesis routes involve intermediate steps of GO exfoliation and subsequent reduction to rGO. Yet the good results obtained in terms of yield come at the cost of quality and consistency. rGO flakes obtained by these methods may greatly vary in planar size, number of layers and chemical purity. Such methods appear particularly challenging due to the impossibility of complete reduction of GO to pure graphene. The remaining defects strongly affect the physical properties of the material, but may also be fundamentally desirable for certain applications, for instance in sensing.

Common top-down graphene fabrication methods rely on liquid-phase processing, thus, deposition out of the liquid phase seems a natural choice. Many applications may benefit from a customized supply form based on beneficial functionalization and immersion in a suitable solvent. For instance, polymer composite production may best utilize graphene supply in form of dedicated masterbatches. In particular, achieving homogenous dispersion constitutes a major challenge for graphene incorporation in elastomers. Supplying pre-dispersed graphene directly within the relevant polymers could provide an elegant solution. In general, precipitation of graphene sheets threatens to annul the desired benefits of graphene incorporation in composite materials. Therefore, prevention of graphene re-stacking represents a major optimization parameter for any conceivable production process. Considerate development of designated forms of graphene supply may allow for better control over adverse effects and for simplification of production routines.

Large-area electronics production often relies on printing and coating steps. Such solution (or dispersion) processes specifically require stable ink formulations complying with other process-specific target parameters, for instance with regard to surface tension and viscosity. Of course, the avoidance of precipitation represents an important factor in ink design when optimizing the composition of graphene flakes, solvents and additives [17]. Adequate ink formulation highly depends on the quality of the graphene utilized, in particular with regard to chemical modification.

In general, several different filler materials and/or additives may be involved in ink or masterbatch formulation. Pre-reactions and other interaction may occur between these different agents. Hence, considerate premixing may aid with processing and improve dispersion results. In any case, compounders may wish to avoid supply of GRM in open powder form to comply with workers' safety rules. So far, potential toxicology concerns with regard to respiration hazards have not been fully refuted.

2.2.2. Electronic grade graphene (EGG)

Bottom-up graphene synthesis mostly relies on CVD growth. In general, the obtained material quality is rather high, but these methods require expensive equipment, where throughput is an issue and scaling requires significant effort. Worldwide, only a few small-scale companies have established themselves as commercial providers of high-quality graphene layers thus far. Typically, they offer CVD material grown on a (multi-crystalline) copper foil substrate using methane as a precursor.

Hence, 'CVD graphene' currently serves as an established expression on the market, despite the fact that CVD also enables the production of flake-type material. Meanwhile, other production methods (such as thermal annealing of SiC or diffusion of dissolved carbon to metal surfaces) also provide material of a similar quality. All the processes mentioned above rely on individual carbon atoms rearranging on the surface of a crystalline substrate material. Experts argue that the expression 'epitaxial graphene' often is exclusively associated with SiC processes though. In general, it also does not represent well the self-consistent property of the 2D layer, which is at least semi-independent of the substrate structure (no systematic covalent bonding to the substrate).

We suggest establishing a terminology based on the intended utilization and (supposed) superior electronic mobility. Hence, we apply the term EGG for the high-end market segment dedicated to the supply of well-defined graphene layers on specific substrates for high-tech applications (such as microelectronics, photonics, or sensors). EGG products range from as-grown material on the native substrate (mostly Cu foil, today) to readily transferred layers on silicon, other substrates, or directly on customer-supplied material.

A multitude of potential applications relies on the use of the superior electronic properties of EGG. In comparison to potential high-volume markets (for the typical top-down, platelet-type graphene materials discussed above), EGG applications appear generally more sophisticated and certainly fall into high-value categories. However, both material quality requirements and value-added may differ by magnitudes between individual EGG applications. In some fields, such as sensors, many users appear fairly satisfied with the commercially available graphene material quality, at least for initial application tests. In contrast, other fields (such as microelectronics or photonics) require much better quality and lower contamination levels. Application development, thus far, mainly relies on research-scale material supply sourced either in-house or through collaborations.

Across the board, all these (rather) high-end applications rely on well-defined, single-layer graphene (rarely defined multi-layers) with a specific (often electronic) function in a (micro-)system context. The most important quality measures include grain size, contamination type and concentrations, as well as defect density. Charge carrier mobility often serves as the primary figure of merit, as most applications directly or indirectly relate to electronic transport properties and all structural quality parameters described above impact mobility.

2.2.3. 2D materials beyond graphene

Beyond graphene, various other 2D materials exist, for instance hBN, phosphorene, various TMDCs including MoS2, MoSe2, WS2, and WTe2, etc. Many of these materials exhibit interesting electrical and/or spin properties. Especially the stacking of different 2D materials on top of each other presents many opportunities to tune these respective properties towards desired applications. Highly promising properties have been found in TMDCs, which is why our focus will be on the processing techniques for these 2D materials in this brief section. Compared to graphene, the production processes are typically less mature for the time being. Of course, exfoliation-based, high-volume production of GRM powders may always be an option for specific GRM types and certain applications. In general, similar factors apply for the high-volume production of alternative GRMs (apart from graphene and its derivatives), only at lower levels of development and maturity.

Typically, high-end, bottom-up growth processes are the best developed. For instance, various possibilities exist to grow TMDCs, including ALD, MBE, CVD, MOCVD and selenization and/or sulfurization of transition metal layers. In general, tremendous progress has been made in the growth of 2D materials in recent years. Although good quality graphene and TMDCs can be grown on the wafer-level already (depending on the application), various parameters might need further development. These include higher degrees of crystallinity and better orientation of the crystals, lower growth temperatures, faster growth processes, reliable and scalable transfer techniques, and growth substrates that allow for easy integration into microelectronics processing lines.

2.3. Graphene utilization context

Existing graphene-enhanced products in the market often base on enhanced polymer and elastomer composites and address high-profile consumer segments. Highly publicized examples include high-end tennis rackets, fishing rods, bicycle tires, running shoes, head phone membranes, etc [16]. Quality and safety requirements in these segments are lower than, for instance, in the automotive sector or for electronic applications. Initial products often faced expert criticism (for GRM incorporation merely as marketing stunt), while recent examples often show credible performance benefits. Energy storage options for portable consumer electronics, flexible electronics, and sensors are further graphene-based products that are commercially available or have reached high market-readiness levels. High-profile applications for heat dissipation [18] and endurance [19] purposes in mobile and automotive contexts, respectively, received particular attention throughout and beyond the GRM community.

The high aspect ratio of graphene flakes (being a micrometer-wide, and under a nanometer thin) and its chemical inertness can also be utilized to influence the barrier properties of matrix materials when incorporating a sufficient amount of graphene. When utilized in a polymer matrix or a functional layer, the arrangement of parallel-stacked platelets in a composite can influence the ingress of water, gases or other contaminants. Penetrating molecules or atoms must diffuse along a tortuous path between the platelets, which significantly reduces mass transport through this barrier layer. Depending on the intended purpose, the hydrophobicity of graphene can add to its barrier properties (when isolating against water is among the desired functions).

Due to its 2D-nature and its thickness of only a single carbon atom, applications such as in transparent conductors have been suggested. Despite being of utmost thinness, a single layer of graphene absorbs 2.3% of light [12], making use in both transparent conductors and light modulators possible.

Owing to its high electronic conductivity, flexible molding into complex shapes, mechanical strength, biocompatibility and stability within the body (it is resistant to the harsh ionic solutions found in the body) [20], graphene has attracted much attention for numerous potential applications in biomedicine. These include biosensors, diagnostics, drug delivery, cancer therapy or biological imaging [21]. Graphene applications seem to be most promising in the nerve and brain stimulation field of neural interface design [22].

A high-value market niche bases on EGG layers (see above). It operates in an entirely different innovation context scheduled for analysis in a forthcoming issue of Graphene Roadmap Briefs. In contrast, many factors described on our roadmap also apply for bulk supply of other 2D materials (even though the development may lag behind several of years). However, our roadmap work presented in the present issue of Graphene Roadmap Briefs explicitly focusses graphene and directly derived materials categories such as GNPs, GO, rGO, etc.

3. The TIR perspective on GRM industrialization

In the frame of the ongoing TIR process, the Fraunhofer Graphene Roadmap Team particularly analyses the innovation context for the industrialization of GRM-enabled technologies [3]. Following a comprehensive assessment of the GRM application portfolio, we developed the novel 3I approach for in-depth analysis of particularly promising areas for GRM utilization. It enables the iterative development of still hypothetical future value chains in confidential exchange with key industrial experts representing all relevant steps of the anticipated supply chain.

In terms of the 3I concept [3], each topic defines a distinct initial materials innovation sphere. Inherently, it often includes specifically relevant interplay with other established or emerging material innovation spheres, but only contains the relevant subset of the GRM innovation system. The latter encompasses the full diversity of GRM, be it derivatives (such as GO, rGO, GNPs, etc) or other 2D materials (such as TMDCs, hBN, silicene, phosphorene, etc) as described above. Each individual focus investigation thus only explores a tiny and highly entangled portion, but their ensemble serves as a surprisingly good indicator for the entire field.

Of course, a limited number of 3I analyses can never truly cover the comprehensive space of conceivable GRM applications in diverse utilization context. Not the breadth of the coverage, but the depth of gathered insights forms the strength of the approach. Each issue highlights the entirety of a single potential future value chain. It links GRM supply with industrial needs derived from specific downstream end utilization context. We carefully choose topics on the forefront of GRM industrialization considering both, their individual promise and complementary nature, in our selection [3].

Still, the growing ensemble will never cover the entire GRM innovation system, but every focus investigation adds another vector of in-depth information spanning that complex space with increasing accuracy. In particular, the overlap and the diversity among the mapped initial materials innovation spheres provides balanced insights into the state and development of the emerging GRM supply industry.

4. The initial GRM industrialization roadmap (2018)

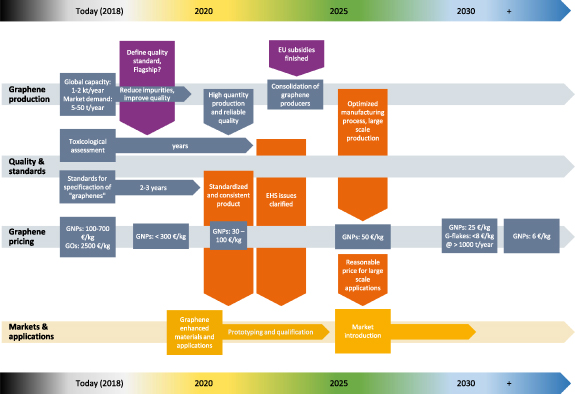

We first aggregated the GRM supply related results from the initial set of four 3I focus investigations in early 2018. Figure 1 summarizes these results gathered by intense stakeholder consultations and four topical roadmap workshops that took place from July 2017 to January 2018 [3]. The roadmap visualizes a GRM cross-application synopsis of the state and expected development of the emerging supply industry on a timeline from 2018 (then 'today') to the year 2030 and beyond. Vertical arrows indicate interdependencies between major areas of development (graphene production, quality and standards, and graphene pricing; horizontal background arrows).

Figure 1. Initial GRM industrialization roadmap (from 2018).

Download figure:

Standard image High-resolution imageIn general, all of the initial focus investigations particularly pinpointed towards the insufficient maturity of the GRM industry representing a major threat and critical bottleneck for the commercialization of the field. Production volume (tiny) and pricing (prohibitive for most conceivable applications) certainly represented clear indicators of (lacking) maturity. However, we identified the supply inconsistency (or the absence of standards, respectively) as the single most critical factor limiting the overall progress of GRM industrialization.

Hence, the interplay of graphene production, pricing, quality control and standardization effectively determines the pace of GRM-enhanced products arriving to market. Supply price reduction depends on improving and scaling production methods. Investment in large-scale production capacity, in turn, depends on increasing demand, or at least the expectation thereof. Beyond added-value propositions for end customers (usually based on advanced performance and/or reduced cost), demand-side development interest severely depends of perceived and experienced maturity. The exploratory roadmap in figure 1 aggregates expert expectations on the general progress of industrialization and on effective pathways to overcome the identified bottlenecks. Please also refer to the supplementary material (figure S1 (available online at stacks.iop.org/tdm/8/022005/mmedia)) for a full-page representation of this roadmap and better visibility of its content.

The status quo at that time served as a starting-point. In 2018, experts estimated a global GRM production capacity estimated of 1–2 kt a−1 as well as an even smaller total market demand of only 5–50 t a−1. The tiny capacity utilization factor indicated both, promise and struggle of the emerging GRM industry. Numerous small suppliers compete for a not yet existing market. Rapid capacity scaling strategies intended to reduce unit cost and attract future high-volume customers, but concurrent sales hardly supported the investment into capital extensive expansion projects.

GRM production cost and pricing remained highly intransparent at that time:

- Desperate needs for marginal returns or desires to gain market share created strong incentives for suppliers to sell well below cost.

- The label 'graphene' summarized a heterogeneous set of material types and qualities with diverse costs and benefits.

- In particular, specific applications require specific graphene properties and support certain price levels.

- The rapid dynamic of the emerging GRM supply industry turned pricing into a moving target, even over the 8 months analysis span the initial data were gathered in.

Generally, GNP type materials often target large-scale bulk applications. Experts reported GNP pricing over a broad range of 100–700 € kg−1 at the time being, of course highly dependent on quality, manufacturing technique and target application. Meanwhile, GOs sold at higher prizes of about 2500 € kg−1. Expectations regarding the pace of cost and prize reduction strongly varied as well. In general, experts considered a cost level of about 50 € kg−1 for GNPs sustainable for initial large-scale GRM applications. Even top GNP grades should reach that cost level by 2025 at the latest, experts foresaw rapid reduction of maximum prices below 300 € kg−1 by 2019 already.

More aggressive targets for less demanding high-volume applications claimed 30–100 € kg−1 to be achievable by the end of 2020. By 2030, high-quality GNPs should become a commodity at a price level of about 25 € kg−1, while the price for lower grades of graphene flakes could decay to under 8 € kg−1 for large-scale utilization upwards of 1000 t a−1. On the long run, 6 € kg−1 may constitute a limit value as seen for comparable micro-carbon products today.

Beyond expansion of production volume and cost reduction, all GRM suppliers involved in the initial focus investigations reported on intense efforts to improve their output quality, in particular with regard to impurity level reduction and consistency of particle distribution (in terms of diameter, layer count, etc). This reflected their awareness of present supply inconsistencies and their role in deterring potential customers. In 2018, industry experts repeatedly reported to abstain from (further) engagement in GRM-related development because they consider the field immature.

Beyond widespread general personal or corporate skepticism towards novel materials (for instance shaped by bad experience with carbon nanotubes (CNTs)), some experts revealed unsatisfactory specific experience with GRM. Besides failed initial trials, successful tests with insufficient repeatability were common, and often traced back to uncontrolled batch-to-batch variations at the GRM supply level.

In consequence, both GRM supply industry experts and potential downstream users recognized the introduction of reliable quality management and sufficient standards of utmost importance for the overall industrialization of the field. The definition of initial standards and basic specifications of relevant GRM species was expected to take about 2–3 years from 2018 onward. Many experts requested public authorities to support standardization and validation processes. In response, the Graphene Flagship recently started an independent validation service and significantly strengthened its participation in international standardization committees.

Meanwhile, also the clarification of EHS issues related to GRM represents an important crosscutting task. Unresolved toxicology concerns deter industrial uptake, but the generation of sufficient data evidencing the benign character of GRM in relevant context (such as potential respiratory intake during processing) will require several years. In the context of safety regulations, European GRM supply industry experts often regarded the obligation for REACH registration as an effective limitation of their production below 1 t a−1, even though GNP production could still be covered under the label of graphite.

In 2018, the experts envisioned GRM suppliers to develop capabilities for high-volume production at consistent quality in compliance with a freshly confirmed standard by 2021. Even before, a substantial base of potential industrial customers should engage in the development of GRM-enhanced (pre-)products for further integration steps, so that a consistent supply would meet an emerging market. Of course, the actual development of (end) products will require an extensive prototyping phase typically lasting for several years. Hence, most urgent EHS issues could be resolved prior to in-breadth market introduction of GRM applications from 2025 onwards. At that time, optimized synthesis routes in the GRM supply industry should support large-scale production at reasonable GRM pricing for initial high-volume applications.

The perspective of rapid market penetration of GRM beyond 2025 still constituted quite a dry spell for the emerging supply industry. Experts expected an extensive consolidation phase and market shakeout among GRM producers in the early 2020s. Already in 2018, they suspected adverse effects from the scheduled expiration of the structured support through the Graphene Flagship mechanism to hit the European industry at a particularly unfavorable timing.

5. Roadmap timing horizons

Prior to the discussion of most recent TIR results (from 2018 onwards) and their implications on the initial GRM industrialization roadmap (figure 1), it appears important to review the timing horizon and its implicit evolution. Essentially, the concept of exploratory roadmapping enables advanced stakeholder coordination based on an attractive, yet realistic, joint success scenario for the long-term future. On this foundation, the diverse involved stakeholders discuss possible pathways to overcome relevant bottlenecks and, eventually, achieve that success scenario. Instead of relatively uncorrelated individual forecasts, the process yields a balanced backcasting [23], how individual progress and mutual interactions in the mid- to short-term future (down to the present day) eventually may enable the joint vision of the success scenario.

In consequence, the different segments of the timing horizon and their practical allocation to certain years (figure 2) plays an essential role for the process. With regard to GRM innovation, we decided to stick specifically with a 2030 horizon (and the rather open label of '+' beyond) consistently throughout all focus investigations so far. Beyond the deviating nature the different topics, 2 also the successive progression of time represents a certain challenge. We already mentioned the slightly different timing of workshops (four issues distributed over the course of 8 month) as source of imprecision regarding the status quo above. Meanwhile, we gathered additional results from six more focus investigations on complementary topics over the course of the last 2 years. In general, this discrepancy does not undermine the overall success of our TIR approach at all. Its main objective is deriving guidelines for mid- and short-term future actions and interactions based on a joint long-term vision.

Figure 2. Visualization of the GRM TIR timing horizon and its development.

Download figure:

Standard image High-resolution imageOf course, the dynamic label of 'Today' utilized in every focus investigation so far signalizes the immediate presence, i.e. the exact timing of each individual roadmap workshop. In practice, however, its only function at that time is an aggregation point for the status quo in the involved innovation spheres and throughout the entire industry. Specifically, it consolidates the status-quo perception of the involved experts, which combines their individual status on global information (accumulated over recent months, probably years at times), implications of private information (internal status and planning within their own entity and business network), as well as individual interpretations and projections on that basis. Hence, 'Today' does never refer to a specific date, but rather refers to the current situation, which, depending on the subject matter discussed, may well stretch out over months or even years into both, past and future.

We do not consider this imprecision a flaw, but a requisite for our exploratory roadmap approach. Here, 'Today' merely represents a reference point to differentiate future developments against the current status quo. In particular, the roadmaps sketch future actions and interactions intended to improve that status quo successively towards the respective success scenario. The approach never aimed to provide an accurate measure of the status quo, but our focus investigations still gathered substantial insight into the status of the emerging GRM industry along the way.

In general, figure 2 summarizes the major timing considerations for the aggregation of GRM industry roadmaps in this chapter. Colors represent past (black), presence (white) as well as the short-term (yellow), medium-term (green), and long-term (blue) segments of the future. Despite the progression of time, we kept medium- and long-term timing horizons constant (in absolute terms) at 2025 and 2030 and beyond, respectively. Figure 2(a) depicts the situation in 2018 (relevant for the first four focus investigations and the initial GRM industrialization roadmap described above). We then allocated the short-term future to 2020, which was 2–3 years ahead at that time. Figure 2(b) directly converts that timeline to the present day. Effectively, the past (black) grew forward and shrunk the future on nearer terms. The presence (white) already reached the initial near-term future, now still located about 2–3 years ahead (yellow). We will utilize this (somewhat distorted) timeline visualization for our general GRM industrialization roadmap progress review and update below.

We also continue to utilize a partially dynamic timeline as depicted in figure 2(c) throughout all focus investigations both in the recent past and for the foreseeable future. Specifically, we carry on utilizing the dynamic label of 'Today' for the status quo; we successively adjust the near-term future to remain roughly 2 years ahead; and we still keep the mid- and long-term steps of the future nominally constant at 2025 and 2030, respectively. Of course, the latter steps come successively closer and we may have to adopt other timing horizons at some point. In the meantime, we recognize two major advantages of our semi-dynamic approach:

- Optimum comparability: all focus investigation cover complementary topics and took place at different dates. Still, the medium- and long-term timing horizons most relevant for aspired success scenarios remain nominally constant and, thus, enable direct cross comparison of timing. More immediate issues (such elastomer composites) produce more roadmap content on near- and medium-term, while the differentiation between long-term (2030) and beyond (+) is more relevant for others (such as neural interfaces). Still, we can directly compare essentially all roadmap graphs and their content on an identical timeline (at least for 2025 onwards).

- Automatic adjustment to general GRM progress: we experience a highly dynamic progress of the entire GRM field. The presence of 2020 significantly advanced over the status in 2017, when the first focus investigation took place. Goals set back then may already in reach today. Progress does not primarily express in the evolution of long-term goals that remain constantly 15 years ahead. Progress often actually materializes in the pathway towards a vision for 2030 becoming more and more concrete. This resonates well with our approach that effectively increases the timing resolution primarily in the near-term future (from dynamic 'Today' to static '2025').

In essence, the TIR approach aims at establishing a shared understanding of GRM commercialization. In particular, each 3I study assembles key stakeholders of a promising GRM application scenario with strongly deviating perspectives that depend on their position on the envisioned value chain and their affiliation context. Here, establishing a joint understanding of near-, mid-, and long-term time horizons may already constitute a major challenge. Typical types of perspective represented at a 3I workshop may include:

- Basic research: the pace of fundamental discovery remains hard to predict. Of course, scientists usually specify research targets in project proposals that typically cover a few years in advance. Substantial advances often require the work of several generations of PhD-students impairing foresight, in particular with regard to application development and commercialization.

- Applied research: our 3I studies often cover advanced GRM applications in applied research or even prototyping stages. Compared to those on lower TRLs, active researchers often already accumulated substantial experience during earlier development phases of that very technology. Hence, their ability to estimate upcoming development targets and the timeline for achieving those appear more robust.

- Start-ups: typically, small-scale companies at start-up level spearhead the commercialization of GRM, in particular on materials supply and immediate application development level. Their immediate concerns unusually include fund raising, up scaling, and process optimization. Even with the secured commitment of their customers, the process leading to a ramped-up production with consistent quality still may take a few years.

- Established companies: in principle, pre-mature supply streams (at small output volumes) may suffice for downstream product development based on GRMs. However, established producers often control higher product integration steps. They often operate on well-clocked sequences for R&D and product generations. GRM-based devices and components may only become relevant beyond the product generation under immediate development. In contrast, technological decisions (for instance for or against GRM integration) often base on near-term market expectations and other factors on a shorter timeline often only 3–5 years ahead.

- Large corporations: particularly on the OEM level, large multinational corporations are common. Sophisticated products often bring longer product development cycles (such as 7 years common in the automotive industry) and pipelines. Their massive structure often impedes or delays visionary development efforts (for instance awaiting GRM supply stream maturation before even engaging). Strict confidentiality measures may also severely restrict the ability of affiliated experts to engage in interactive roadmap discussions.

While it might appear easy for researchers to formulate visions for 2030+, representatives of established industries are often more cautious with assumptions on a timeframe even before 2025. In effect, we often observe an inversion of common uncertainty assumptions. Near-term roadmap items (such as achieving certain research targets) may be timed with least certainty, while items with well-defined time requirements (such as end-product development and market introduction cycles) only become relevant further down on the horizon. Here, we recognize a specific strength in iteratively deriving intermediate milestones from a success scenario (backcasting, see above). The representation of key stakeholders all along the envisioned value chain in our 3I workshops ensures comprehensive consistency checks on the succession and relative timing of milestones. Hence, our roadmaps often yield realistic commercialization scenarios despite often involving rather speculative elements, in particular on the near-term progress of application-specific GRM research.

6. The GRM industrialization roadmap 2020

Based on the time horizon considerations above, figure 3 shows a progress review and update of the initial GRM industrialization roadmap from 2018. The design and positioning of content supports direct comparison between the 2018 (figure 1) and 2020 (figure 3). Please also refer to the supplementary materials for full-page representations of both roadmaps (figures S1 and S2) as well as a convenient overlay version of both (figure S3) specifically supporting the comparison.

Figure 3. General update: GRM industrialization roadmap 2020.

Download figure:

Standard image High-resolution imageThe industrialization progress in the meantime (between 2018 and 2020) is best characterized as consolidation phase with little quantitative expansion, but significant qualitative improvement. Specific progress review items appear on the 2020 roadmap (figure 3) in red color. As discussed above, accumulated global production capacities remain rough estimates even in hindsight, but our meta-market observations indicate little net increases since 2018. Obviously, significant capacity expansion still occurred at the level of individual (successful) GRM suppliers, but largely balanced by overall reductions of surplus capacities. Meanwhile, we observe a steady increase of market demand, but still a rate lower than envisioned earlier. We will further discuss the status and prospects of the GRM industry below, but want to highlight a recently achieved milestone in GRM standardization [11] here. It defines advisable protocols to measure application relevant GRM properties and, thus, supports the formation of reliable customer–supplier relationships in the emerging industry sector. The number of GRM-based niche products on the market steadily increases as well. The Graphene Flagship highlights a collection of notable products related to the project on their website [24]. For instance, we discussed the GRM-enhanced bicycle tires by Vittoria as a possible precursor of future mainstream GRM utilization in the car tire industry in one of our 3I focus analyses. Experts often highlight Ford [19] and Huawei [18] as first examples of GRM utilization in high-profile mass products. Both raise the industrial awareness of the superior thermal conductivity of graphene [14] over traditional graphitic materials often used in similar contexts.

However, experts still characterize the current state of the emerging GRM supply industry in 2020 by the colloquial term 'Graphene Zoo'. It refers to the vast diversity of mostly small, start-up type suppliers offering various types and grades of graphene and GRM (GNPs, GO, etc). This situation often creates a perception of general immaturity and insufficient reliability among potential customers. Individual and joint efforts of graphene producers concentrate on relieving themselves and their products of such generalizations.

So far, successful business cases often rely on trusted (end) customer relations usually built by specific bilateral co-development projects. Typically, entities from the emerging GRM supply industry constitute the driving force, motivated by their struggle to develop sustainable business models that ensure both, their immediate survival today and their long-term growth perspectives. Often they partner up with niche producers of specific end products and, thus, skip established supply chains. Some readily available products (for instance bicycle tires or running shoes) certainly evidence success cases. The actual GRM demand generated by such product co-developments at that scale will obviously vary significantly, but probably remain on the order of 1 t a−1 for each individual case. Meanwhile, the common desire of end-product developers to receive ready-to-use solutions requisites significant personnel and financial resources on the side of the GRM supplier. Hence, their capacity to engage in such bilateral co-development initiatives remains strictly limited. Careful selection of most promising projects appears essential for their survival on the market.

However, GRM industry experts unanimously claim their ability to scale production output immediately, once a corresponding demand should arise. Of course, creation of new physical production facilities always requires finite timescales, but experts mentioned concrete scale-up plans being readily available and only delayed due to insufficiently secure sales perspectives, and thus financing.

In various constellations, several GRM producers join forces already today to work upon critical factors in the graphene industrialization context together. In particular, the creation of relevant standards may serve as a signal to potential customers improving their perception of GRM maturity. Standards will certainly help to streamline supply-and-demand interactions in the future.

Present standardization work may build upon the recent GRM characterization standard [11]. Its completion creates a foundation for independent enforcement of technical specifications. The next logical step constitutes the definition of material standards, but GRM utilization requisites largely depend on the target application. Likely, only application-specific KCCs may provide a meaningful performance measure. Here, successful niche operations certainly aid the identification of useful KPIs as a basis for product-category-specific GRM supply standards including relevant KCC. On the long run, experts hope these efforts contribute to the definition of a meaningful ISO standard for graphene, which will likely take at least until 2025. Enforcing the compliance with and regular validation of standards throughout the industry will be a long process that could eventually benefit from the widespread availability of relevant in situ characterization techniques.

In analogy, several GRM suppliers have already formed an open consortium that addresses REACH legislation today. Successful registration of any specific material under REACH constitutes a mandatory prerequisite for any supplier active within the EU to produce more than 1 t a−1. Regulatory requirements increase with overcoming certain annual production volume thresholds. Members of the consortium hope to compile sufficient documentation to apply for advanced REACH registration levels for more than 100 t a−1 and 1 kt a−1 by 2021 and 2023, respectively. In general, experts often consider remaining toxicology concerns, both justified and perceived, a major bottleneck for the market diffusion of graphene (and nanoparticles per se). Once resolved, the topic may turn into a major driver though, in particular when novel GRM solutions promise to replace more toxic products common on the market today.

Consistent with the vague deadlines set to scale-up production to commodity levels (with demand being perceived as a crucial bottleneck, see above), GRM industry experts turn successively more reluctant to allocate specific KPI and unit cost targets on a timescale. Still, there was agreement upon significant cost reduction being a crucial target and enabler for commercial diffusion of graphene materials into applications in volume markets, such as elastomers. However, consensual expectations foresee the price of simpler graphene materials (such as nanoplatelets, GNP) dropping to about 20 € kg−1 by 2022 (for large volumes). At that cost level, an increasing number of graphene applications should become competitive, which could enable the graphene industry to enter a maturation phase governed by economics of scale, i.e. continuous price and cost reduction coupled with exponential growth of cumulative total production. Eventually, carbon black often serves as the ultimate benchmark for graphene. Today, the comparison identifies potentially attractive use cases. In some cases, GRM producers claim to already achieve or overcome relative (measured by performance) pricing equivalency with relevant carbon black grades (for instance as conductivity additive). On the long run also absolute (in unit cost) pricing equivalency might be in reach beginning in the late 2020s. Eventually, even the discussion of societal scale ecologic impact might turn into a driver of GRM diffusion as carbon black replacement with potentially lower carbon footprint.

On the near term, most GRM producers mainly strive to improve their primary output characteristics, for instance with regard to the yield of single-layer flakes. Some mainly target mass production and supply, but the majority aim at higher value propositions by offering customized solutions to their prospective clients. With regard to the primary production output this may materialize in the ability to consistently functionalize graphene at scale. Supplying graphene derivatives (GO/rGO) with reliable concentration of functional sites constitutes a near-term goal. On the long run, specialized suppliers will offer customized complex (bio-)functionalization schemes. Others already begin with diversification towards other (non-graphene) 2D materials such as hBN, TMDCs, etc. However, the majority of GRM producers strives to tailor higher value products to the processing needs of their customers. In particular, we explored printable inks and pastes as a requisite for various applications ranging from flexible electronics over wearable devices to perovskite photovoltaics. Among many other perspectives, the development of suitable master batch products for diverse polymer composite production contexts represents a particularly valuable opportunity.

Eventually, GRM diffusion will greatly benefit from the emergence of an initial lead market requesting high-volume supply, which would eventually perpetuate the scaling of production into the desired economics of scale regime. Of course, we frequently explored this crucial bottleneck and potential industrialization breakthroughs in the context of several focus investigations. Diverse composite material technologies represent likely candidates to form the initial volume lead market for GRM. In particular, elastomer composites appear promising for rather low technical GRM incorporation barriers as evidenced by early niche products (bicycle tires, running shoes). Only the initial GRM-enhanced product line in the common passenger vehicle tire segment will likely require about 10 kt a−1 of elastomers equivalent to 200–500 t a−1 of graphene consumption. Due to long industrial qualification cycles and extreme GRM production cost reduction requirements, experts expect this market breakthrough not to take place before 2026, and wider diffusion in the car tire market will still take several years beyond 2030. In analogy, successful utilization of GRM in advanced lithium ion battery anodes alone could open a substantial market opportunity. Battery market projection foresee a demand of at least 1 Tw a−1 by 2030. This translates into an anode material demand of 100–1000 kt a−1. A GRM incorporation level of 1%–10% would then result in a market demand of 1–100 kt a−1 for that single purpose alone.

7. Conclusions

The supply of GRM forms the starting point of all innovation chains in every 3I focus investigation we carried out over the past 3 years. Already in 2018, our initial set of 3I studies indicated the insufficient maturity of the GRM supply industry as a major threat and critical bottleneck for the commercialization of GRM-based products. The consolidation of all subsequent 3I studies now paints a more differentiated picture, in particular regarding the overall progress of the GRM supply industry and the growth of a dedicated innovation ecosystem. Beyond cost reduction and capacity expansion, the GRM industry still faces interrelated challenges of (a) the perception of their immaturity among potential customers, (b) a lack of standardization and reliability, and (c) regulatory hurdles (such as REACH) associated toxicology concerns.

In practice, beneficial GRM specifications highly depend on the specific application context. New GRM applications often emerge from start-ups or university spin-offs. Their materials synthesis and characterization usually follows unique protocols. Hence, results are often hard to compare, and (potential) industrial users find it challenging to select the right materials for their application from the range of 'graphenes' available on the market. Currently, successful GRM producers mitigate this gap by engaging in bilateral co-development of end products, typically with individual SME-type partners.

Overall, this business model may likely prolong rather than accelerate the industrial diffusion of GRM. The desire to protect competitive advantages in a certain market niche often drives strict non-disclosure measures. Low visibility of niche success cases, however, does not reduce the skepticism among global players, who run very different business strategies.

Large OEMs require commoditized supply through a globally diversified network, hardly feasible for the present GRM industry. Thus, OEM hardly engage in any GRM-based product development so far and largely remain in an observant position. In turn, GRM suppliers struggle outgrowing their start-up niche. They usually report on tangible scale-up plans—and on indefinite delays due to a lack of current market demand and, thus, funding. The deadlock is apparent and severely affects the overall diffusion of GRM technology. Both processes, the technical implementation of GRM supply at scale and the development of GRM-enhanced mass products will still consume ample time once started.

Eventually, this risk aversion dilemma will resolve, but timing and consequences appear unclear. On a global scale, less risk-averse regions (such as China) may lead GRM industrialization and capture most benefits. Secretive first movers may capitalize on major competitive advantages. Such sudden release of the deadlock may also trigger a commercial hype phase in case several OEM simultaneously seek to compensate their inactivity by the acquisition of niche players and outbid each other on a dry market.

Many experts both expect and hope for a lead market resolution, where some initial volume market (e.g. tires or batteries) drives the overall industrialization of GRM. The scenario appears likely based on the number and diversity of GRM applications, but may also produce undesirable side effects. Potential lead markets may consume significant ramp-up time, thus delaying general GRM diffusion many years. Peculiarities of most applications may still hamper the direct utilization of the GRM supply stream then, when specifically tailored to a single lead market. Even the expectation of some lead market to come may turn detrimental itself when justifying prolonged inactivity.

In either case, the dawning decade appears decisive for the GRM innovation system and its industrialization. By 2030, we expect clear indications whether it eventually grows into a comprehensive materials innovation system as influential as silicon or steel, or whether it fades into the general nanomaterials regime similar to CNTs. The present decade will also largely determine GRM lead markets on both geographic (EU vs. China vs. USA) and on application (batteries, tires, etc) levels and, thus, the allocation of future benefits. At present, scientific research already produced compelling evidence for the efficacy of graphene in numerous disciplines and applications. Beyond graphene, several other 2D materials (such as hBN, TMDCs, etc) follow on similar paths, but their development usually lags behind, of course.

Several active strategies may accelerate the resolution of the current deadlock of GRM industrialization. Suppliers may intend to grow their market by co-development (of specific end products), by tailoring supply streams (to certain market demands), by strategic dumping (gambling on future revenue based on economics of scale), or by joining forces in community efforts (on regulation, standardization, etc). OEM may try to secure first mover advantages with GRM-enhanced products. Established material suppliers may close the gap between supply and demand by refining or guaranteeing supply streams. Beyond applied research, scientists may engage in validation, standardization, and regulation processes as well. Beyond primary research funding, policy may influence GRM diffusion through subsidization, regulation, and similar measures.

We recognize trusted relationships and information exchange across industries a key requisite that foreshadows future supply-demand relations. The TIR process and 3I focus studies may trigger or strengthen such exchange. Roadmaps aggregate perspectives and create a common view that may enhance trust in the technology and its innovation prospects. In particular, they help to manage industrial expectations and, thus, to overcome the side effects of hype cycles (inflated expectations and disillusionment).

Acknowledgments

This project has received funding from the European Union's Horizon 2020 research and innovation programme under Grant Agreement Nos. 696656 (GrapheneCore1), 785219 (GrapheneCore2), and 881603 (GrapheneCore3).

The authors thank all other members of the Fraunhofer Graphene Roadmap team including Bernd Beckert, Julia Beyersdorf, Piret Fischer, Michael Friedewald, Karin Herrmann, and Ulrich Schmoch for their general support of our focus investigation strategy and/or for their instrumental role in some of our past 3I studies.

We highly appreciate the input from numerous Flagship partners, industry experts, and other relevant stakeholders who we interacted with us, who participated in our workshops, and who validated our reports since 2017. We appreciate Alison Tovey from the IoP design team for her support to improve our illustrations and roadmap designs.

Footnotes

- 1

Note that non-carbon 2D materials and their bulk production and supply are not specifically covered here for still neglectible bulk production and related economic activities. However, most of our roadmap results may apply in analogy (and with a certain time lag) for their bulk supply as well. Other 2D materials may be of special interest for electronic-grade utilization, a topic excluded for this very analysis here.

- 2

For instance, neural interfaces may require a much longer term visions than GRM incorporation in composite materials, where initial products like bicycle tires or running shoes are readily available today.